Top 5 Types of Market Intelligence

1. Competitive Intelligence (CI): Gaining an Edge Over Direct Competitors

Competitive Intelligence (CI) focuses on systematically gathering and analyzing data about your direct and indirect competitors. This includes insights into their strategies, product updates, pricing, and market activities. CI sources information from both public domains and internal teams such as sales, customer support, and customer success.

By leveraging CI, businesses can stay ahead of their competitors, devise specific strategies to win deals and develop battle cards to outmaneuver rivals. Additionally, CI insights empower organizations to anticipate competitive moves, benchmark their performance, and refine their operational and go-to-market (GTM) strategies.

Examples and Value of Specific Information for Competitive Intelligence

1. M&A/Deals Intelligence:

- What It Involves: Analyzing competitors’ mergers, acquisitions, and partnerships.

- Why It Matters: Provides a window into their strategic priorities and future direction. For instance, if a competitor acquires a services company, it may signal a shift toward adding a service layer to their offering. Similarly, a partnership with a technology startup might indicate an effort to bolster new technical capabilities.

2. Business & Financial Performance:

- What It Involves: Tracking metrics such as funding received, revenue growth, profitability, and overall financial health.

- Why It Matters: Helps assess a competitor’s market positioning and financial stability. This insight is crucial for identifying whether they’re a rising threat or a declining rival. It also aids in setting benchmarks, calculating market share, and reallocating resources more effectively.

3. Business Expansion:

- What It Involves: Monitoring competitors’ geographic expansions and market penetration efforts.

- Why It Matters: Identifies overlaps or emerging competition in new territories. For example, tracking a competitor entering a specific market can alert you to growth opportunities or potential threats in that region.

4. Client Wins:

- What It Involves: Observing competitors’ major customer acquisitions and retention successes.

- Why It Matters: Offers insights into their sales and marketing effectiveness. If a competitor wins a key account in your target segment, analyzing their approach can reveal strategies to refine your positioning and engagement tactics.

5. Go-to-Market (GTM) Initiatives:

- What It Involves: Assessing competitors’ strategies for reaching and engaging customers.

- Why It Matters: Highlights strengths and weaknesses in their tactics, enabling you to fine-tune your own GTM efforts. For instance, if a competitor launches a significant campaign on a platform you’ve overlooked, it may prompt you to diversify your marketing channels.

6. Leadership Posts on Social Media:

- What It Involves: Tracking what competitor leaders share on platforms like LinkedIn and Twitter.

- Why It Matters: Often overlooked, this offers insights into their strategic priorities, values, and potential vulnerabilities. For example, a leadership emphasis on sustainability might signal a pivot toward environmentally conscious business practices.

7. Content Resources:

- What It Involves: Analyzing published assets such as blogs, white papers, and case studies.

- Why It Matters: Reveals competitors’ expertise and market positioning. If a competitor frequently publishes content about a specific use case, it could signify their leadership and focus in that domain.

Case Study

| A global consulting firm leveraged Competitive Intelligence to track mergers and acquisitions by competitors in France and China. These insights enabled their clients to prepare for upcoming launches and proactively respond to potential market shifts. |

2. Customer or Account Intelligence: Strengthening Relationships

Account Intelligence is the practice of gathering detailed information about key clients to understand their needs, priorities, and pain points. This account intelligence helps businesses tailor their products and services to meet specific client requirements, enhance customer satisfaction, and—most critically—reduce the risk of losing them.

For instance, discovering that a new CXO has been appointed at a key account may indicate potential risks to your relationship. Acting proactively, you can develop strategies to mitigate these risks and solidify your position. Similarly, if a prospect collaborates with your competitor on a joint webinar, you could consider organizing similar initiatives with the competitor’s rivals, potentially converting them into new clients.

Examples and Value of Specific Information for Account Intelligence

1. Company Profile:

- What It Involves: A unified view of the client organization’s structure, operations, leadership, and strategic priorities.

- Why It Matters: Aligning your communication and strategies with the client’s decision-making processes greatly increases your chances of success. For example, understanding a client’s leadership hierarchy enables personalized communication with decision-makers, making your outreach more impactful.

2. Key Strategic Updates:

- What It Involves: Monitoring news, press releases, market movements, and other updates of strategic importance affecting the client’s operations.

- Why It Matters: Staying informed about major developments allows for timely and proactive engagement. For instance, a press release about a client partnering with a reseller could reveal new sales channels that you could explore to further strengthen the relationship.

3. Management Changes:

- What It Involves: Tracking transitions in leadership roles and assessing their implications for the client’s strategy.

- Why It Matters: Leadership changes are critical indicators of shifting priorities. They can represent both risks and opportunities. For example, a newly appointed CIO might prioritize digital transformation, opening doors for technology providers, while a new CEO may decide to reevaluate vendor relationships, requiring you to safeguard your position proactively.

4. Client’s Industry Trends

- What It Involves: Analyzing trends within the client’s industry to understand the broader challenges and opportunities they face.

- Why It Matters: Industry insights help you anticipate your client’s evolving needs and craft solutions that address these challenges. For instance, noticing a growing emphasis on sustainability in your client’s sector could lead you to pitch eco-friendly solutions that align with their strategic direction.

Case Study

A manufacturing firm that carefully monitored leadership changes and market updates for its key accounts was able to anticipate potential risks and address them proactively. This intelligence-driven approach reduced churn rates by 50% while simultaneously driving a 20% increase in sales through timely, tailored engagement strategies.

3. Product Intelligence: Innovating with Confidence

Product Intelligence focuses on gathering insights about competitors’ products, ranging from features and pricing to customer feedback and performance. It provides a broader perspective by analyzing competitors’ entire product ecosystems and innovation strategies. The insights gained can directly inform product development, innovation roadmaps, and pricing strategies, helping businesses refine their offerings and stay competitive.

Examples and Value of Specific Information for Product Intelligence

1. New Products and Enhancements:

- What It Involves: Tracking competitors’ new product launches and updates.

- Why It Matters: Provides insights into emerging market demands and potential competitive threats. For instance, a competitor launching a budget-friendly product might signal their intent to target price-sensitive segments, prompting you to re-evaluate your own pricing strategy.

2. Innovation Intelligence:

- What It Involves: Monitoring technological advancements and their integration into competing products.

- Why It Matters: Spotting innovations early enables businesses to maintain a competitive edge and enhance their own product features. For example, if a competitor introduces AI-powered features, it could inspire you to accelerate similar innovations in your product roadmap.

3. Product Pipeline Intelligence:

- What It Involves: Analyzing competitors’ upcoming product launches, updates, and long-term development trends.

- Why It Matters: Helps you proactively adjust strategies to mitigate risks or capitalize on opportunities. For example, tracking a competitor’s pipeline of eco-friendly products could push you to fast-track sustainable solutions to maintain relevance.

4. Patent Intelligence:

- What It Involves: Reviewing competitors’ patent filings to understand their research and development (R&D) priorities.

- Why It Matters: Provides critical insights into competitors’ innovation focus while helping you avoid potential legal disputes. For instance, a competitor patenting a new production method may highlight the need to diversify your processes or innovate within your own R&D framework.

Case StudyAn aerospace company leveraged Product Intelligence to monitor competitor innovations in satellite technology. By closely analyzing new launches, technological advancements, and patent activity, the company was able to anticipate market shifts and proactively enhance its own product offerings, solidifying its position as a market leader. |

4. Procurement Intelligence: Strengthening Supply Chains

Procurement Intelligence transforms supply chain management from a reactive process to a proactive strategy, ensuring businesses are prepared to tackle challenges and leverage opportunities as they arise. Procurement Intelligence centers on gathering and analyzing data about suppliers, vendors, and the broader supply chain. This intelligence is crucial for optimizing sourcing strategies, mitigating risks, and building resilient procurement processes.

Beyond ensuring cost-effectiveness, Procurement Intelligence helps businesses maintain a close watch on supplier health for the timely identification of potential risks. For example, early detection of operational challenges can help businesses proactively address potential supply chain disruptions.

Examples and Value of Specific Information for Procurement Intelligence

1. Supplier/Vendor Intelligence:

- What It Involves: Analyzing the reliability, capabilities, and risk factors of suppliers and vendors.

- Why It Matters: Ensures a stable and efficient supply chain by identifying potential risks before they cause disruptions. For instance, monitoring a vendor’s challenges, such as delays or quality issues, might prompt you to diversify your supplier base to maintain operational continuity.

2. Financial Performance:

- What It Involves: Reviewing suppliers’ revenue, profit margins, debt levels, and cash flow.

- Why It Matters: Assesses the financial stability of suppliers, reducing the risk of interruptions caused by insolvency. For example, spotting a supplier with cash flow struggles might encourage you to renegotiate payment terms or identify alternate vendors to mitigate risks.

3. Operational Challenges:

- What It Involves: Monitoring issues such as supply chain disruptions, quality concerns, and capacity constraints.

- Why It Matters: Helps avoid production bottlenecks and ensures seamless operations. For example, identifying delays in a supplier’s production schedule early could enable you to plan contingencies, such as increasing inventory buffer stock.

4. Sustainability Practices:

- What It Involves: Evaluating suppliers’ environmental and social responsibility initiatives.

- Why It Matters: Aligns your supply chain with sustainability goals and meets customer and regulatory expectations. For example, partnering with suppliers committed to reducing their carbon footprints can enhance your brand’s image and sustainability credentials.

5. Legal and Regulatory Risks:

- What It Involves: Monitoring pending lawsuits, compliance issues, or regulatory changes affecting suppliers.

- Why It Matters: Helps avoid reputational damage and ensures uninterrupted supply. For instance, if a key supplier faces legal challenges over safety standards, identifying and switching to an alternative vendor can safeguard your operations.

Case StudyA global IT company leveraged procurement intelligence to ensure they were doing business with legitimate third parties before onboarding any new third-party vendors. Staying on top of regular vendor updates helped reduce their exposure to supply chain and compliance risk. |

5. Industry Intelligence: Staying Ahead of the Curve

Industry Intelligence involves tracking the broader market, covering trends, technological advancements, regulatory changes, funding patterns, and more. It provides the context needed to navigate dynamic markets and uncover opportunities. It enables companies to remain compliant, innovative, and aligned with market shifts by monitoring government policies and legal requirements, identifying emerging technologies to stay ahead, and understanding evolving needs to craft targeted strategies.

Examples and Value of Specific Information for Industry Intelligence

1. Recent Industry Trends:

- What It Involves: Tracking developments in market demand, emerging customer preferences, or shifts in competitive dynamics.

- Why It Matters: Identifies areas for innovation or adaptation to maintain relevance. For example, observing a rise in demand for renewable energy solutions might prompt you to explore offerings in the clean energy space.

2. Significant Developments:

- What It Involves: Monitoring impactful events like mergers, acquisitions, or regulatory changes in the industry.

- Why It Matters: Helps you understand the competitive landscape and anticipate challenges. For example, a new regulation mandating stricter data privacy measures might require you to update your compliance processes.

3. Analyst Viewpoints:

- What It Involves: Reviewing expert opinions and forecasts on market trends and industry dynamics.

- Why It Matters: Offers deeper insights from field experts, helping refine your strategies. For example, analyst predictions about a market downturn could encourage you to adjust your investment priorities proactively.

4. Technological Advancements:

- What It Involves: Identifying emerging technologies and innovations reshaping the industry.

- Why It Matters: Helps businesses stay competitive by adopting relevant technologies early. For example, noticing a new technology adding efficiency in operations at other companies in the industry might inspire similar investments to maintain parity.

5. Funding and Investments:

- What It Involves: Monitoring capital inflow into the industry through venture funding, IPOs, or M&A activity.

- Why It Matters: Reflects growth areas and emerging competition. For example, a surge in funding for electric vehicle startups might highlight a shift in consumer interest, encouraging you to evaluate this market segment.

6. Emerging Customer Preferences:

- What It Involves: Understanding evolving consumer needs and behaviors.

- Why It Matters: Enables you to tailor offerings and remain relevant in changing markets. For example, observing a growing preference for personalized services might lead you to incorporate tailored solutions into your product line.

Case StudyA global sanitation company relied on Industry Intelligence during the pandemic to track shifting regulations and market conditions. By aligning their operations with emerging needs, they managed to grow sales by 20% despite widespread industry challenges. |

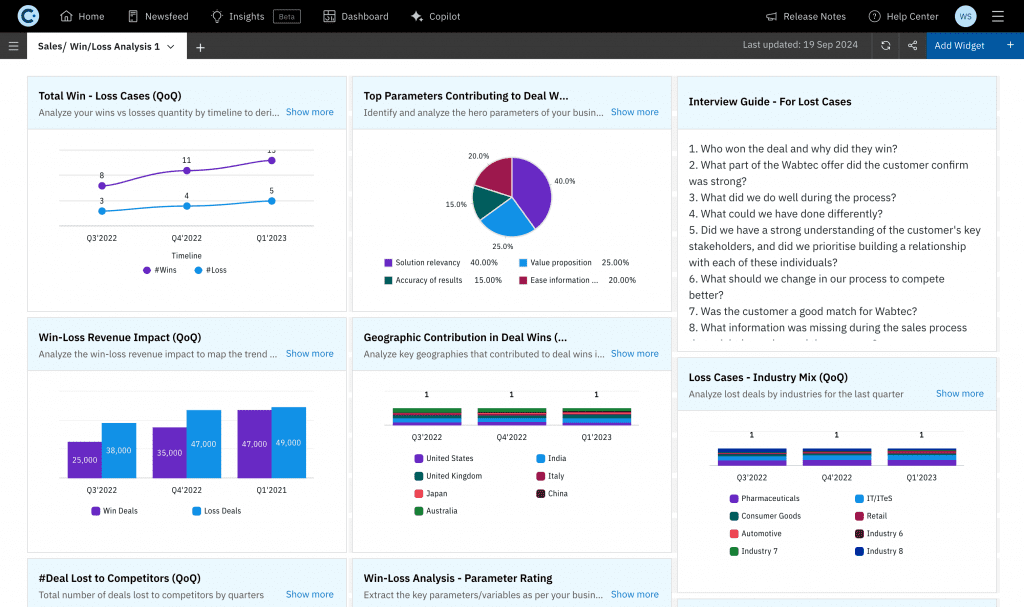

Why Use Specialized Market & Competitive Intelligence (M&CI) Tools to Supercharge Your Strategy?

In today’s fast-paced business environment, specialized Market and Competitive Intelligence tools are no longer optional—they are essential. These tools go beyond traditional methods to deliver insights that empower businesses to anticipate market shifts, outpace competitors, and seize opportunities. Here’s why relying on M&CI tools is a game-changer:

1. No More Manual Research Delays

- The Challenge: Traditional manual competitor research is time-consuming, inconsistent, and often outdated by the time insights are ready. This can lead to missed opportunities and delays in responding to competitive or market shifts.

- How M&CI Tools Help:

M&CI tools consolidate fragmented competitor data into a single, unified dashboard, making it easier to stay updated on competitor activities like pricing strategies, product launches, and marketing tactics. By delivering timely insights, these tools enable businesses to act faster than their competition.

2. Move From Reactive to Proactive Decision-Making

- The Challenge: Companies relying solely on historical or anecdotal data often end up reacting to competitors’ moves or market changes instead of proactively shaping their strategies. This can result in missed growth opportunities and a lack of differentiation.

- How M&CI Tools Help:

By aggregating data from internal and external sources, M&CI tools generate actionable insights tailored to specific functions. These insights allow teams to refine product development, optimize pricing, and fine-tune marketing strategies—all while staying ahead of competitors.

3. Filter the Noise for Better Market Visibility

- The Challenge: The vast amount of scattered and noisy data can overwhelm decision-makers. Without a clear understanding of broader market trends, businesses struggle to anticipate shifts, mitigate risks, or capitalize on emerging opportunities.

- How M&CI Tools Help:

Specialized intelligence tools cut through the clutter, delivering only contextual and role-specific insights. This includes tracking specific competitors, industry regulations, and technological advancements in real-time, allowing businesses to make data-backed strategic decisions.

4. Gain Industry-Wide Awareness for Competitive Advantage

- The Challenge: Many businesses limit their scope to tracking direct competitors, missing out on industry-wide dynamics like regulatory changes, emerging technologies, or investment trends that could significantly impact their operations.

- How M&CI Tools Help:

M&CI platforms provide a 360-degree view of the market by combining data on competitors, industry trends, and customer behavior. This comprehensive approach ensures that decision-makers are not just focused on immediate challenges but are also prepared for long-term industry shifts.

Conclusion: Connecting the Dots with Integrated Intelligence

Market and Competitive Intelligence is not just about gathering information, it’s about deriving insights that drive actionable decisions. Each type of intelligence discussed above plays a crucial role in building a comprehensive understanding of your business environment.

The real power of intelligence lies in integration. Combining Competitive, Account, Product, Procurement, and Industry Intelligence provides organizations with a unified view of their markets, helping them act decisively and strategically.

Specialized M&CI tools empower businesses to move beyond reactive, time-consuming, and siloed approaches to intelligence. They deliver actionable insights that drive proactive decision-making, enable differentiation, and unlock new opportunities. Leveraging the right tools can be the difference between thriving and falling behind.

A robust market intelligence platform like Contify brings all these intelligence types together, delivering tailored, actionable insights to decision-makers across functions.

By integrating M&CI platforms like Contify into your workflow, you can:

- Centralize fragmented data for a single source of truth.

- Deliver timely and noise-free insights tailored to different roles and functions.

- Enable teams to anticipate trends, refine strategies, and stay ahead of the competition.

Ready to transform your approach to intelligence?

Take a free trial of Contify today and experience the power of comprehensive Market & Competitive Intelligence.