Most businesses will agree that their market landscape is increasingly competitive, fragmented, and complex these days. Customers are spoilt for choice as new competitors continue emerging at an incredible pace. This rise in new competition is largely driven by rapid technological advancements, which have significantly reduced entry barriers across industries. For example, in 2021, nearly 5.4 million applications were filed in the US to form new businesses, marking a 53% increase from 2019 and the highest number recorded in any year. In 2022, 5.1 million, the second-highest ever. Source: Census Bureau Therefore, yesterday’s competitive differentiation and competitive intelligence strategies will not be sufficient to tackle tomorrow’s challenges. It’s time to rethink how you monitor competitors, especially when new competitors are entering the market faster than ever.

In this article, we’ll discuss eight effective strategies and tools to identify competitors, including how to track competitors, assess their threat, integrate them into your competitive intelligence program, and how a competitive intelligence platform can help. Let’s start by understanding why new competitors pop up. It’s not always technology innovations.

Why do New Competitors Pop up?

Markets consist of multiple participants engaging directly (vendor-customer) or indirectly in a sequence to create value chains. The nature of these engagements is not static. Each participant tries to maximize both its market share (maximize revenue) and profit margins (minimize cost). . As competitors in the market evolve to gain an edge, new gaps and opportunities emerge, as do potential competitors.

These gaps often go unnoticed, leaving room for agile startups or future competitors to capitalize. These changes create gaps in the market that are sometimes not addressed for a long time and opportunities that the existing players do not immediately capture. These players, because of their inertia, are sometimes slow to react. These gaps create room for the fast-moving agile startups or future competitors to capitalize. Let’s explore some of the reasons behind this:

1. Evolving Consumer Needs: New competitors arise to fill gaps in the market created by evolving consumer needs. For example, initially, businesses managed their IT infrastructure in-house, which was costly and complex. AWS and Azure recognized this market gap for the need for scalable, flexible, and cost-effective IT solutions.

2. Technological Innovations: Tech innovations lower cost and raise efficiency, enabling emerging competitors, like fintech startups to challenge legacy players.

3. Regulatory Changes: Changes in regulations can disrupt the status quo and invite new competition. Deregulation has opened doors in telecom and pharmaceuticals, spawning primary competitors almost overnight.

4. Globalization: Easy market entry across geographies means new competitors entering the market are no longer restricted by location. For example, companies like Spotify and Netflix have successfully entered various international markets, reshaping the local music industry.

5. Evolving Cultural Trends: Slow shifts in consumer behavior, driven by generational changes fuel direct-to-consumer brands, creating new business competitors in existing markets. The success of direct-to-consumer brands in various sectors, from eyewear (like Warby Parker) to mattresses (like Casper), illustrates this trend.

Now, let’s figure out ways to spot these new competitors before it is too late.

How to Identify New Competitors

Here are eight proven techniques to identify your competitors before they start impacting your deals:

1. Sales Calls

In the B2B world, the most valuable insights about the market often emerge from the interaction between your sales team and customers. Sales teams are on the front lines, engaging with prospects and clients, and this interaction is a crucial source for identifying new competitors. These new competitors must be taken seriously because they have already entered your prospects’ consideration set.

Your sales teams are the front line for identifying direct competitors. Whenever prospects mention unfamiliar names, train sales to probe deeper. Transcripts of sales calls can help you find company competitors that are already part of the decision-making process. You can also track competitors’ marketing angles based on how customers describe them.

Regularly scrutinizing sales call recordings serves as an early warning system for new players entering the market. In addition, this data can also highlight shifts in customer preferences, your competitive alternatives, or new products and services by your competitors.

2. Analyst Reports

Market research firms such as IDC, Gartner, and Nielsen are essential to find business competitors. These reports categorize and evaluate all key players in a segment, even the future competitors just gaining traction.

Mining analyst reports is one of the most effective methods of determining competitors across different tiers. By mining these reports, you can uncover emerging competitors, gaining a clearer picture of their strengths and weaknesses. These new competitors cannot be taken lightly because prospective customers often refer to them for guidance.

3. Industry Events and Conferences

Events provide opportunities to track competitors in real-time. Demos, booths, and speaker panels offer first-hand insights into how new competitors are positioning themselves and what their competitor marketing strategy is.

But it’s not just about their products. It’s the conversations, the demos, and the interactions that truly matter. These events offer the best opportunities to identify competitors in the market who are targeting the same audience and understand how they position themselves, their unique selling points, and their strategies.

4. Social Media

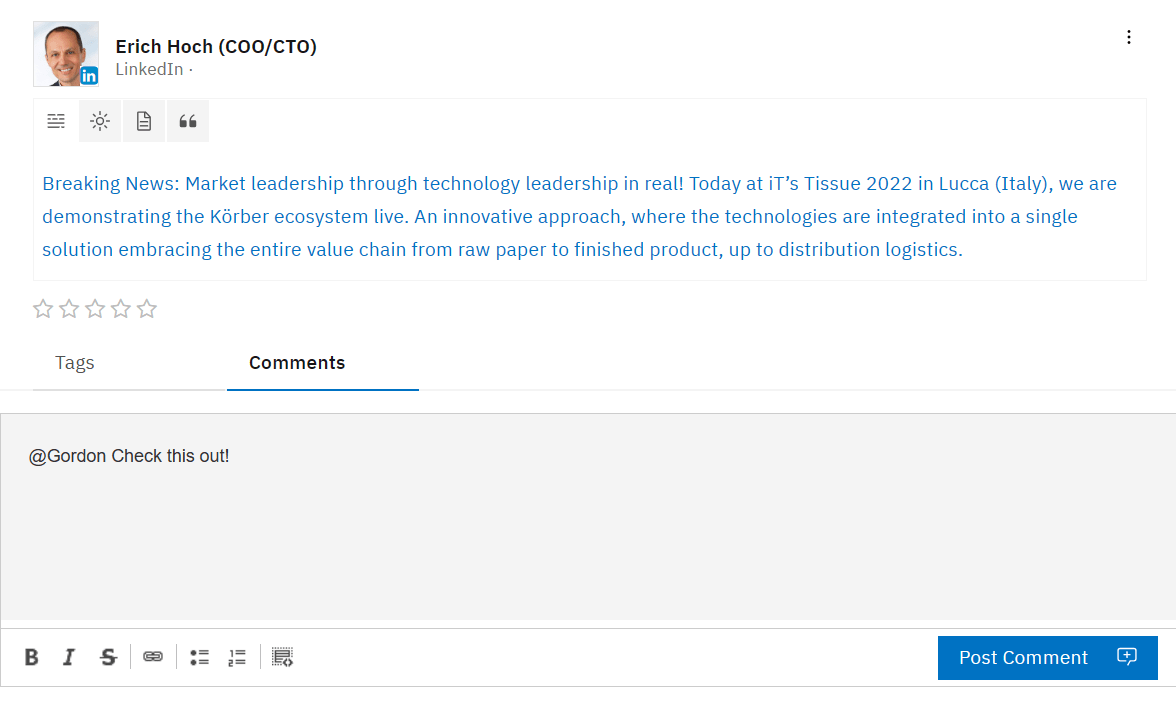

A social media update from a key executive captured in the Contify platform.

Social platforms are goldmines for tracking competitors. Monitor executive updates, community discussions, and LinkedIn group mentions. A casual comment or shared link might help you find your direct competitors early. This includes participating in industry-specific LinkedIn groups and following influential voices on Twitter.

Here, you might stumble upon mentions or comparisons of emerging players. Sometimes, a simple comment with a link to a new competitor’s website can open doors to fresh insights. The comment would only say, “You should check out,” and a link to the competitor’s website.

5. Press Releases and News Articles

Monitoring press and PR announcements helps you track competitors’ marketing strategy, partnerships, funding rounds, and go-to-market signals, especially for emerging competitors entering new verticals.

New competitors usually announce on these channels when they release a product or raise capital before entering your market segment.

6. Customer Reviews

A customer review update captured in the Contify platform.

Platforms like G2, TrustPilot, and Gartner Peer Insights are full of user comparisons. These are essential to know your competition, especially when customers mention alternatives or up-and-coming vendors.

These reviews reveal what customers like or dislike, giving clues into competitor segmentation and differentiators.

7. Patent and Trademark Filings

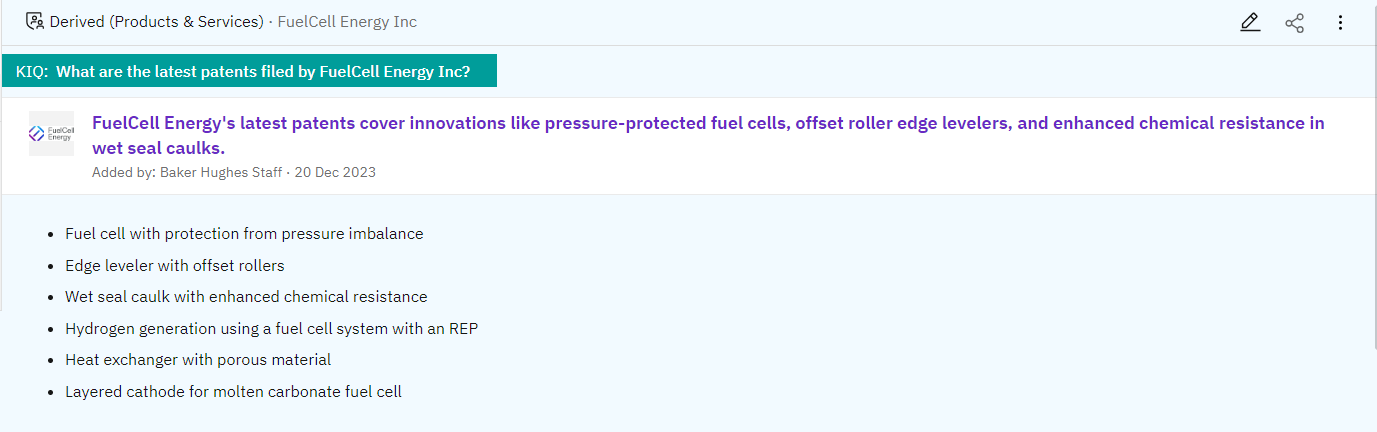

An insight about a competitor’s patent derived from multiple updates in the Contify platform.

Regularly monitoring patents lets you spot potential competitors in business and their innovation pipelines. Platforms like USPTO and EPO are good starting points to identify business competitors entering adjacent product categories.

The key is regularly searching for new filings in your industry segment and technology domain to spot new competitors. This requires a certain level of technical understanding to interpret these documents and understand their potential market impact.

By systematically applying these techniques, businesses can detect new competitors early and start to understand their potential impact. The next step is to evaluate these newly identified competitors.

8. Non-English Sources

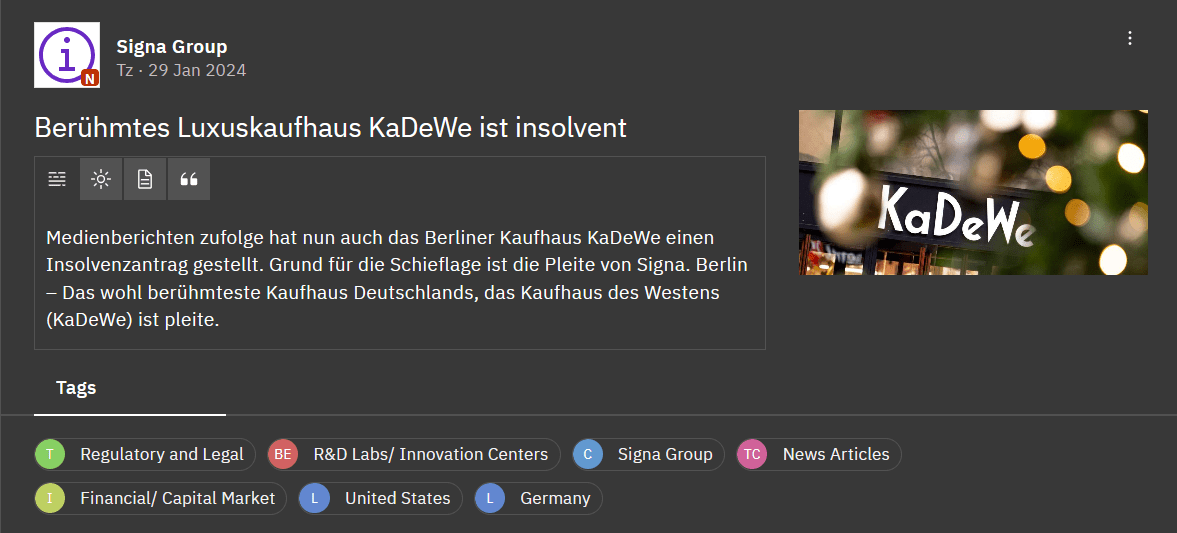

A non-English update captured in the Contify platform.

If your customer base spans regions, how to find competitors of a company requires multilingual coverage. Competitors information from local news or forums in non-English sources can help you spot future competitors examples before they reach the global scale.

How to Understand New Competitors

Do not limit your understanding of new competitors to who they are or what they bring to the table. Evaluating these new players is crucial to developing a long-term view of your market. Once identified, here’s how to research competitors’ different marketing strategies and evaluate their potential:

1. Value Proposition

Delve deeper into what the new competitors offer and what makes them unique. Start with website copy, social posts, and pitch decks to dissect what the new competitors offer. Identify the specific problems they solve and how customers respond.

Get hold of their marketing collaterals, pitch decks, and product demos and critically analyze all aspects of their offerings. Additionally, conduct customer interviews and surveys to understand the most valuable aspects of competitors’ offerings and compare them to yours.

This approach will help you know your competitors beyond surface-level info.

2. Positioning & Messaging

New competitors’ positioning and messaging offer a window into their strategic thinking. Pay attention to their marketing campaigns and public relations efforts. What messages are they emphasizing? Are they focusing on product quality, customer service, price, security, technology, or something else?

How they define their brand identity and discuss their offering and (your) customers’ problems could reveal their target market segment. Understanding this will help you refine your own competitor marketing strategy and fill gaps.

3. Customer Reviews

New competitors usually have fewer reviews and feedback. However, even if fewer in number, these reviews are crucial in understanding them and their customer base.

To assess new competitors, examine their customer satisfaction ratings, reviews, and scores on platforms like G2, Trustpilot, Peer Insights, and customer testimonials on their website, including within case studies and press announcements.

Review platforms give deep insights into how to identify competitors and how they’re perceived. Look for trends in complaints or praise; these are invaluable for positioning and competitor comparison.

4. Pricing Strategy

Analyzing new competitors’ pricing reveals their strategy, market positioning, and target customer segment. One common strategy new competitors follow is to capture customers by undercutting existing pricing models. And if their offering is better and prices are lower, you’d have to lower your prices to retain your customers.

You could rely on your loyal customers to share these details to find new competitors’ pricing. Or, you could hire a third-party CI company to get their pricing details. You could also try your luck and directly call them and ask for the prices of their offerings. Sometimes, over-enthusiastic sales reps share detailed pricing models and other useful information.

Once you’ve evaluated new competitors and concluded that some of them could become a real threat in the future, you should include them in your market intelligence program and start monitoring them.

Monitoring new competitors requires a strategic yet measured approach, distinct from how you track your primary or direct competitors. In-depth competitive intelligence demands significant time and effort. Therefore, it’s critical to select the primary competitors wisely and keep a high-level tab on secondary or emerging competitors.

How to Monitor New Competitors

You should start by adding a new competitor as one of the options in your CRM so that the sales teams can tag it whenever it is mentioned on a call. Analyzing the transcripts of sales calls with competitors in the market will help you collect valuable intelligence about them.

This can be streamlined by integrating the sales call transcripts from the sales call recording system into your M&CI platform.

If you are not using a sales call recording system, your Market and Competitive Intelligence (M&CI) program is missing out on one of the most valuable sources of intelligence.

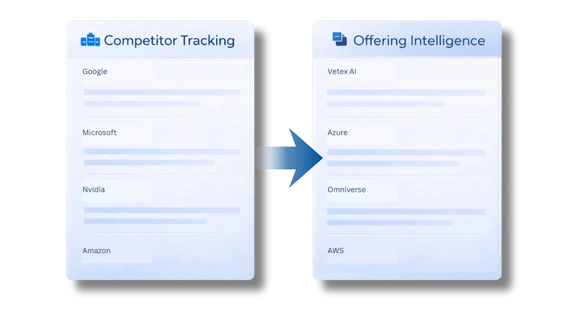

Also, include these new competitors in your standard monitoring of secondary sources for intelligence such as news mentions, press releases, and social media for insights into their management changes, product launches, customer feedback, partnerships, or funding announcements. This high-level tracking provides a helpful overview without the need for in-depth monitoring, such as website changes or job posting analysis.

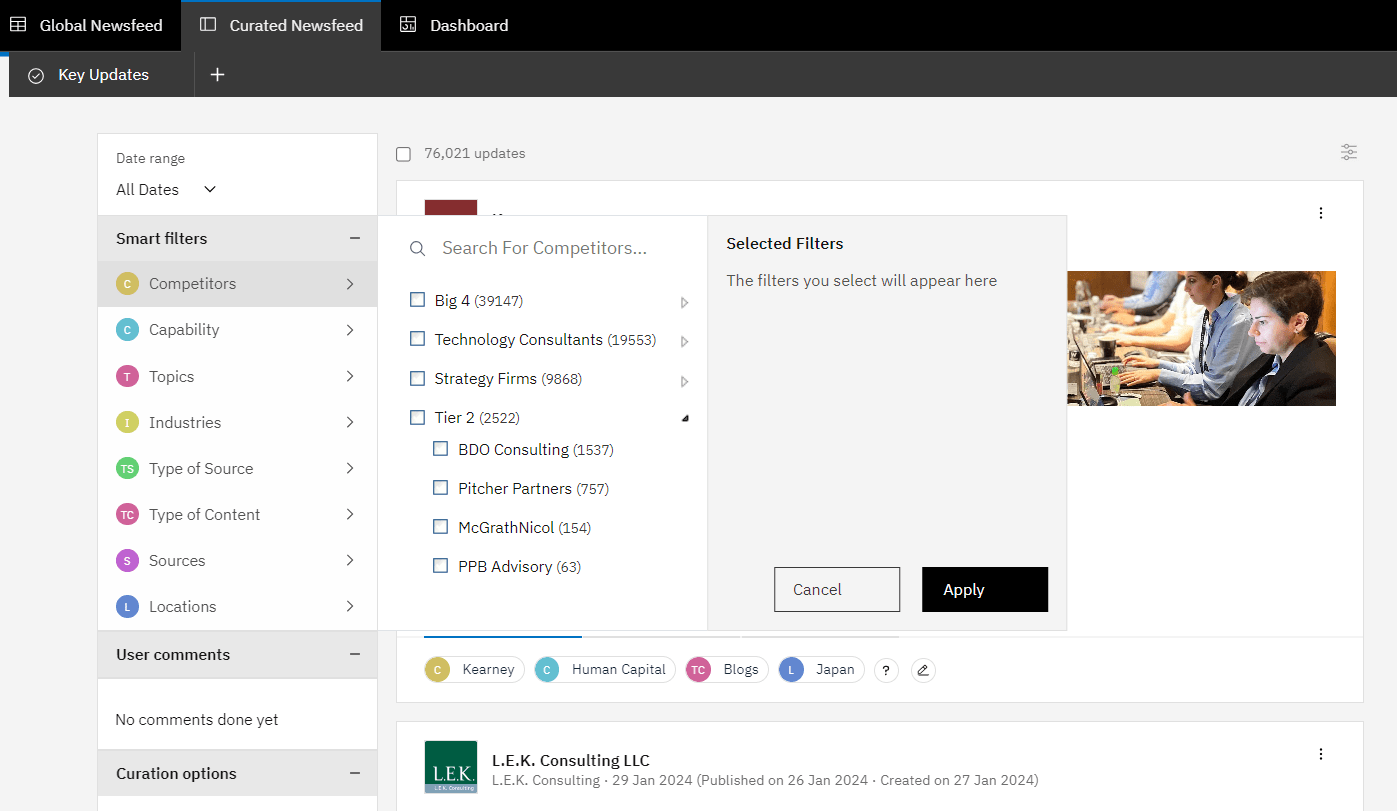

A taxonomy in the Contify platform showcasing Tier 1 and Tier 2 competitors

You should include new competitors in the primary list only if you start losing deals to them. This triggers a need for a deep dive and thorough understanding of their strategies and offerings – followed by a detailed battle card against them. Balancing vigilance with efficiency ensures that you’re wisely utilizing your energies by focusing on the most important competitors.

To stay ahead in this game, consider setting up custom alerts and notifications to track specific activities of new competitors, like new product launches, pricing changes, or changes in their executive team. Here’s a pro tip: subscribe to their newsletters and follow their social profiles to keep a pulse on their latest moves.

You can also enhance your competitor monitoring by setting up alerts and notifications based on specific triggers, such as product launches, pricing changes, or leadership movements. Bonus tip: Subscribe to their newsletters and follow their page on all the social channels these new competitors keep updated.

With a robust Market Competitive Intelligence (MCI) tool, you can efficiently gather insights on hundreds of potential competitors. This way, you’re well-informed about them even before they start showing up in your sales team’s competitive bids. This approach is essential for staying one step ahead in a fast-paced market.

The Role of an M&CI Platform in Tracking Competitors

In addition to the tactics mentioned in the section ‘how to monitor new competitors,’ you can identify new competitors by monitoring general industry developments that enable you to know the competition better. Therefore, your market and competitive intelligence platform must be able to help you identify competitors, track them across multiple sources, and gather structured competitors information, including non-English and custom sources.

Whether you’re trying to find direct competitors, detect new competitors, or understand how to identify your competitors in unfamiliar markets, Contify gives you the tools to do it.

Tracking new competitors is easy in Contify because it tracks 1mn+ sources by default. This is in addition to custom sources required for deep monitoring of your specific competitors.

We have not included an exhaustive list of all Contify features and capabilities to keep this blog concise and focused. If interested, you can review Contify’s full suite of capabilities in this interactive demo.

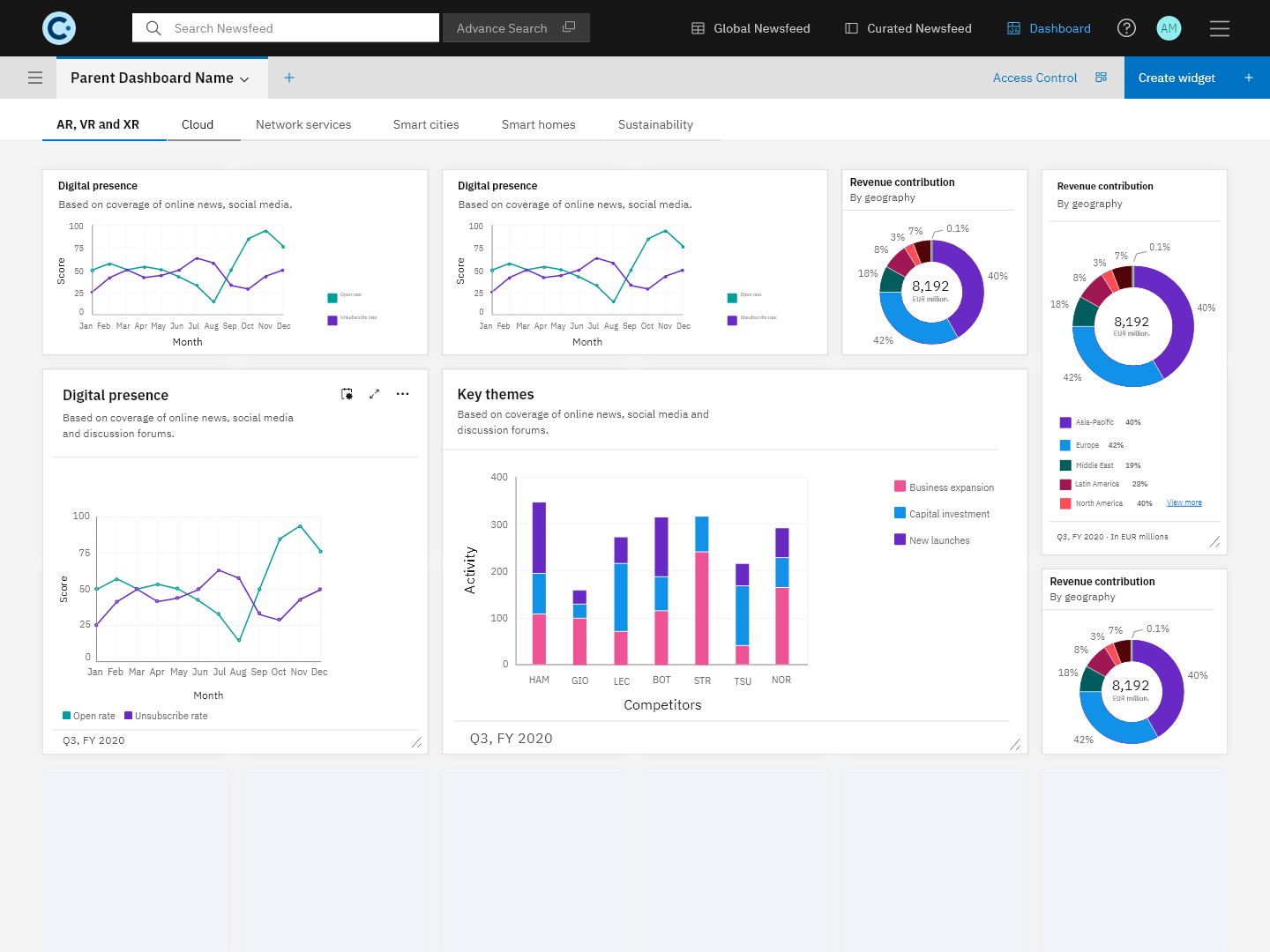

A sample dashboard in the Contify platform.

Conclusion

Technology breaking down barriers and the internet democratizing knowledge, combined with lower IT infrastructure costs and easier access to funding, has created a storm for disruptions in almost all industries. Therefore, competition is coming from all directions. However, finding competitors for a company is not a one-time exercise , but an ongoing process. With technology accelerating disruption, new competitors are always on the horizon.

Even if you’re not losing deals to them yet, it’s crucial to identify your competitors early and stay informed. These potential competitors often signal shifts in demand and offer clues to what customers want next.

But when your sales teams do not encounter a new competitor in the deals, is it still important to track them? The answer is a resounding “yes.” For one, they bring fresh approaches, innovative products, and unique strategies to captivate your customers. Secondly, their emergence can signal shifts in customer preferences or unmet needs in the market – insights that are gold for developing forward-looking strategies.

Implementing a Market and Competitive Intelligence (M&CI) program is crucial to thriving and surviving in this business environment. Such a program should be backed by powerful M&CI tools that harness the latest AI technologies to bring efficiency and let you easily expand the scope of your intelligence program.

Embracing advanced, technology-driven tools like Contify becomes indispensable in this context. This saves time and resources and provides deep insights for making strategic decisions in a market teeming with new competitors.

Explore the power of Contify today and redefine how you gather, analyze, and utilize market and competitive intelligence. Take a 7-day free trial .

Frequently Asked Questions

2. What are the signs that new competitors are entering the market?

Common signs of new competitors entering the market include changes in customer buying behavior, mentions during sales calls, increased activity on review platforms, new funding announcements, patent filings, or media coverage. Keeping an eye on these indicators helps in identifying competitors in the market early.

3. How can sales teams help in identifying new competitors?

Sales teams play a critical role in how to find competitors of a company. During conversations with prospects, they often uncover names of potential competitors that aren’t yet on the radar. Training them to capture and share this competitor information ensures early detection and better competitive readiness.

4. What tools can I use to monitor new entrants in my industry?

To track competitors effectively, use M&CI tools like Contify, which aggregate insights from news, press releases, social media, review platforms, and non-English sources. These platforms make it easy to identify your competitors, monitor activity, and categorize them into primary competitors or future competitors.