Overview

If you feel your market is evolving faster than ever, you’re not alone. Most business leaders feel the same today. To put that into perspective, in PwC’s Annual Global CEO Survey 2024, 45% of CEOs mentioned they lack confidence that their companies will survive over a decade if they continue on their current path.

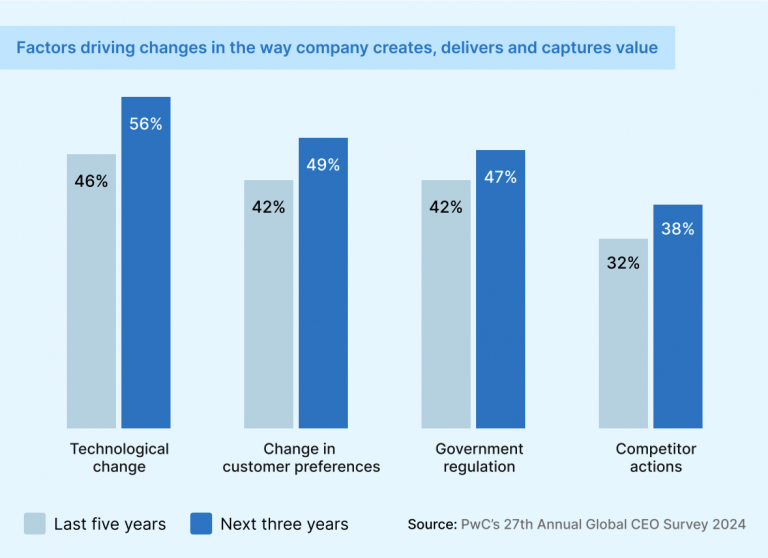

In fact, more than 38% of CEOs agree that factors such as technological changes, shifts in customer preferences, government regulations, and competitor actions are expected to influence business models at an even greater rate in the next 3 years than in the past half-decade.

Therefore, Market and Competitive Intelligence (M&CI) platforms are emerging as critical strategic tools in which organizations are investing. They are purpose-built solutions that unify external and internal data, customized according to your business context, and provide actionable insights across multiple use cases and functions. These platforms give teams the clarity and agility to respond swiftly to market shifts.

But with so many M&CI platforms available in the market—determining the best fit for your business can be overwhelming. That’s why we created “2025 Buyer’s Guide to Choosing the Right Market and Competitive Intelligence Platform” to make the evaluation process easier for you.

The guide compiles all the lessons we have learned over a decade working with medium and large enterprises and understanding what works (and what doesn’t) when it comes to evaluating and selecting M&CI software.

In this blog, we’ve condensed core insights from the guide. Read on to understand M&CI platforms and key considerations that will help you navigate the buying process confidently and choose a solution that fuels long-term success.

What is an M&CI Platform, and What Are Its Benefits?

An M&CI platform is a comprehensive software solution that enables organizations to collect, analyze, and distribute insights – gathered from multiple internal and external sources. It gives businesses a 360-degree view of their market landscape, industry trends, emerging technologies, regulatory changes, supplier issues, competitor moves, and customer needs.

These platforms automate the time-consuming processes of collecting data from external and internal sources, organize it according to set criteria, support analysis with advanced AI-based capabilities, and provide key insights to internal users in different roles across business units.

By adopting the right M&CI platform, companies can:

- Improve decision-making: Get insights that guide enterprise-wide decisions, enabling teams to collaborate effectively and act with better clarity, confidence, and agility.

- Find growth opportunities: Spot emerging trends, new markets, or partnership possibilities early, helping you increase your revenue and market share.

- Mitigate risks: Catch early warning signals on regulatory shifts, supply chain issues, or competitor threats to effectively minimize disruptions.

- Drive sales enablement: Provide battlecards, competitor playbooks, key account insights, and sales support in strategic deals to improve win rates.

- Inform product strategies: Analyze market gaps by benchmarking competitors, staying updated on trends, and understanding buyer needs to refine offerings roadmap for customer relevance.

- Sharpen go-to-market plans: Gain insights into competitors’ strategies, strengths, and weaknesses to craft effective messaging, refine product positioning, and develop go-to-market strategies.

- Enhance operational efficiency: Automate intel collection, analysis, and distribution, freeing teams from manual efforts and allowing them to focus on high-value activities.

- Improve cross-functional collaboration: Break down information silos with a single source of truth for your market landscape, enhancing alignment and cohesive decision-making.

How Do You Know It's Time to Buy an M&CI Platform?

In the current business landscape, market variables, including rapid technological advancements, emerging competition, fluctuating buyer expectations, and evolving business models combined, make it challenging for companies of all sizes to stay agile and well-informed.

A well-chosen M&CI platform serves as a “command center,” delivering near real-time insights to the teams that need them the most. However, not every company needs a sophisticated M&CI platform right away. But certain key signals suggest your business can’t wait:

- Growing competition and shorter innovation cycles: New players are entering your space with stronger value propositions, leveraging new technologies, and maintaining shorter innovation cycles.

- AI reshaping business models: Your industry is witnessing rapid AI-led developments, and competitors are leveraging AI to enhance operations, personalize customer experiences, and launch innovative products.

- Supply chain vulnerabilities and procurement risks: Geopolitical instability, unexpected competitor partnerships, and limited vendor visibility are exposing you to supply chain risks, impacting costs and profitability.

- Rising regulatory pressures: Increasing volume and complexity of regulations are raising the risk of compliance pitfalls, wherein non-compliance incidents could cost you heavy penalties and reputational damage.

- Information overload and decision paralysis: Teams are struggling with too much data, which is leading to indecision and missed opportunities.

- Siloed intelligence across teams: Intelligence scattered across departments is limiting collaboration, slowing decision-making, and creating inefficiencies.

- Slow market response and missed opportunities: Relying on ad-hoc intelligence results in delayed reactions to competitor moves and market shifts, costing deals, and growth opportunities.

- Manual processes slowing intelligence efforts: Traditional M&CI processes are unable to scale, limiting efficiency and the ability of your teams to respond proactively to market changes.

- Declining sales win rates: Sales teams struggle to differentiate offerings and counter objections due to outdated or missing competitive intelligence, leading to lost deals and shrinking win rates.

If two or more of these signals sound familiar, it is an indication that you should now consider a robust M&CI platform. It will help address these challenges effectively and ensure that your business-critical decisions are grounded with strategic market insights rather than being made in a vacuum.

Setting Business Requirements

Before investing in an M&CI platform, figuring out your business needs is important. Setting clear goals and requirements helps you choose the right tool that best fits your company’s needs. Key steps here involve:

- Identify stakeholders and their goals: Pinpoint who relies on competitive and market insights—leadership, strategy, sales, marketing, product, and procurement. Ask each group about their key objectives and the decisions they need to make to achieve them.

- Develop Key Intelligence Questions (KIQs): Translate stakeholder objectives into focused KIQs (e.g., “Which new AI technologies are our competitors deploying?” “How are buyer preferences shifting?”). KIQs guide data collection and keep efforts aligned with real business needs.

- Define scope—market participants and topics: Decide who and what you need to track—competitors (direct and emerging), customers, partners, suppliers, regulators, and intelligence topics (M&A activities, technological disruptions, or new product categories). Clarity here prevents drowning in irrelevant data.

- List the sources to gather intelligence from: Outline essential external sources (news outlets, social media, regulatory sites) and internal repositories (CRM, conversation intelligence tools, Slack), as high-quality insights stem from a mix of internal and external sources.

- Identify intelligence sharing formats and modes: Define how intelligence will be delivered—newsletters, real-time alerts, dashboards, or integrations with existing tools like MS Teams or Salesforce, ensuring it’s tailored to the unique preferences of stakeholders.

With these requirements mapped out, you’ll have a strong framework to evaluate each vendor’s fit.

Assessing Vendor Compatibility

Choosing a vendor that fits your business well is important, as this will be a long-term partnership.

The vendor’s offerings, expertise, support services, and security measures should meet your organization’s selection criteria and the context of your industry. Consider the following aspects:

- Does the vendor have proven experience with your industry use cases? Review their case studies to learn about their clients and use cases.

- How satisfied are the vendor’s existing customers? Check their customer reviews on G2, Gartner Peer Insights, or TrustRadius.

- Does the vendor have endorsements from respected analyst firms (Gartner, Forrester) or recognized associations like SCIP? These accreditations indicate their position in the field and speak volumes about their reputation.

- Does the vendor offer a free trial of their platform? Testing the platform before committing reveals usability, data and AI accuracy, and overall fit.

- Does the vendor provide managed services, if required? A vendor who can act as an extension to your M&CI team helps you manage ad-hoc requests such as deal support, in-depth event analysis, new battle cards, and competitor profiling.

- Does the vendor share best practices to help you establish a winning M&CI program? Beyond offering technology, a reliable vendor should serve as a strategic partner, offering valuable resources to help design, implement, and optimize your M&CI program.

- Check whether the vendor adheres to data security and privacy standards such as SOC2 and GDPR. A vendor’s adherence to these standards reflects their commitment to protecting client data and maintaining high trust.

These considerations ensure that your M&CI platform won’t just look good in a demo but also genuinely support your strategic business goals for years to come.

Evaluating Platform Capabilities

Beyond vendor credentials, examine the technical and functional features of the platform. Key questions include:

After vendor-level considerations, you need to do a detailed evaluation of the functional aspects of the M&CI platform.

It’s essential to consider a range of capabilities so that your chosen solution aligns with your near-term intelligence requirements and can scale to adapt to future needs. Key capabilities to consider:

Data Sources & Coverage

- What data sources are included on the platform by default? Determine the range of publicly available sources in the platform, such as company websites, news and PR sites, regulatory websites, patent databases, social media, review sites, etc.

- Does the platform collect data directly from sources or purchase it from other third parties? Platforms with proprietary sourcing infrastructure offer greater flexibility to add custom sources, unlike those reliant on third-party data feeds.

- Can the platform integrate internal intelligence alongside external data? Platform with the ability to source intelligence from internal sources (CRM notes, sales call transcripts, win-loss analyses, and field team insights) ensures a comprehensive market view that reflects your company’s internal perspective and voice of buyers.

- What is the platform’s historical data availability? Some platforms provide little to no historical data, making your teams wait months before meaningful insights emerge. Opting for a solution with out-of-the-box historical data provides immediate value, enabling you to analyze trends, benchmark competitors, and assess market changes.

Taxonomy & Tagging

- What are the initial pre-configured tags available on the platform taxonomy? Assess what kind of out-of-the-box tags the platform offers. It could include Companies, Sources, Locations, and intelligent tags like Business Events, Themes, and Industries.

- How easy is it to set up and modify your custom tags (taxonomy)?

Intelligence priorities evolve over time, so your platform should support custom taxonomy creation and modifications. Ensure it allows easy adjustments to tags and categories to align with your KIQs and strategic objectives.

Artificial Intelligence & Data Analysis

- Does the platform offer a Conversational AI interface? Check if it provides a chat-based interface to ask queries and get immediate, context-aware answers grounded in your intelligence data. This feature boosts enterprise-wide usability.

- Does the platform leverage a knowledge graph for deeper insights? Evaluate platform capability beyond AI summarization to capture and connect data points from lengthy articles, helping transform unstructured content into highly relevant role-specific insights.

- What analysis and visualization capabilities are provided? Assess the platform’s data visualization capabilities, such as word clouds, topic analyses, trend spotting, benchmarking comparisons, etc. A good platform will have auto-updating dashboard visualizations.

- Does the platform support multi-language analysis and translation? If you operate globally, a platform that provides translated content from non-English sources will help you capture valuable intelligence that might otherwise go unnoticed.

Integrations & Accessibility

- Does the platform integrate with your existing tools and workflows? Look for solutions that can integrate into your CRM, KMS, and ERP systems so intelligence is shared right where your team already works. Also, check for two-way data flow to ensure employees can share primary insights without leaving their daily apps.

- Which channels can you use to distribute intelligence? Check if you can share curated insights via email newsletters, alerts, and integrations with Slack or Microsoft Teams. Be mindful of user licensing—some platforms might require each recipient to have a paid seat, which can inflate costs.

- Is data export functionality supported? Having this capability helps with advanced analytics, running custom reports, and switching vendors later on to ensure the continuity of your intelligence program.

- Are APIs available for deeper customization? A vendor who can provide APIs that let you integrate market intelligence into portals, ERP, or CRM can provide a fully tailored intelligence experience, embedding curated insights wherever your teams need them most.

By evaluating the M&CI platform on these important capabilities, you can ensure that it will meet your immediate needs while scaling as your intelligence function matures.

Download the Guide

Having the right M&CI tool not only boosts your competitive edge, but also supports steady growth for years.

With a glimpse into these essential considerations, you’re well on your way to selecting the right market and competitive intelligence platform that meets your business needs, strengthens your market position, and ensures long-term success.

Download the full guide now for a deeper dive into these frameworks, best practices, advanced evaluation questions, to simplify your evaluation process.