While both provide critical insights for businesses to make informed decisions, their applications, methodologies, and purposes differ significantly. This article will explore the nuanced difference between Market Intelligence and Market Research, delving into their definitions, categories, and their roles in business success.

What is Market Research?

Market Research is the process of collecting, analyzing, and interpreting data to answer a specific business question. Companies conduct Market Research to gain insights into their target market, identify growth opportunities, and make informed business decisions.

These questions are usually strategic — not day-to-day operational or transactional questions. Common questions for Market Research projects include:

– Who are the key market participants (competitors, customers, regulators, or suppliers), and what are their strategies, strengths, and weaknesses?

– What are the emerging needs and preferences of our target customers?

– What are the gaps and niches in the market that we are best positioned to serve?

– What is our products’ market perception/ positioning, and what enhancements should we make to differentiate them in the marketplace?

– What would be the most effective go-to-market strategy for our products or services?

– What should be the pricing strategy for our products or services?

– How can we differentiate ourselves from competitors and create a unique value proposition?

– What risks and challenges do you need to overcome or mitigate?

Insights from Market Research enable companies to develop products or services that directly address customer pain points, thereby increasing the likelihood of market adoption and customer loyalty.

Market research also helps align various aspects of a business—product development, marketing, and even operational processes—with market needs and opportunities.

Market Research can be categorized along different dimensions, such as qualitative vs. quantitative, or primary vs. secondary. Here’s a brief overview:

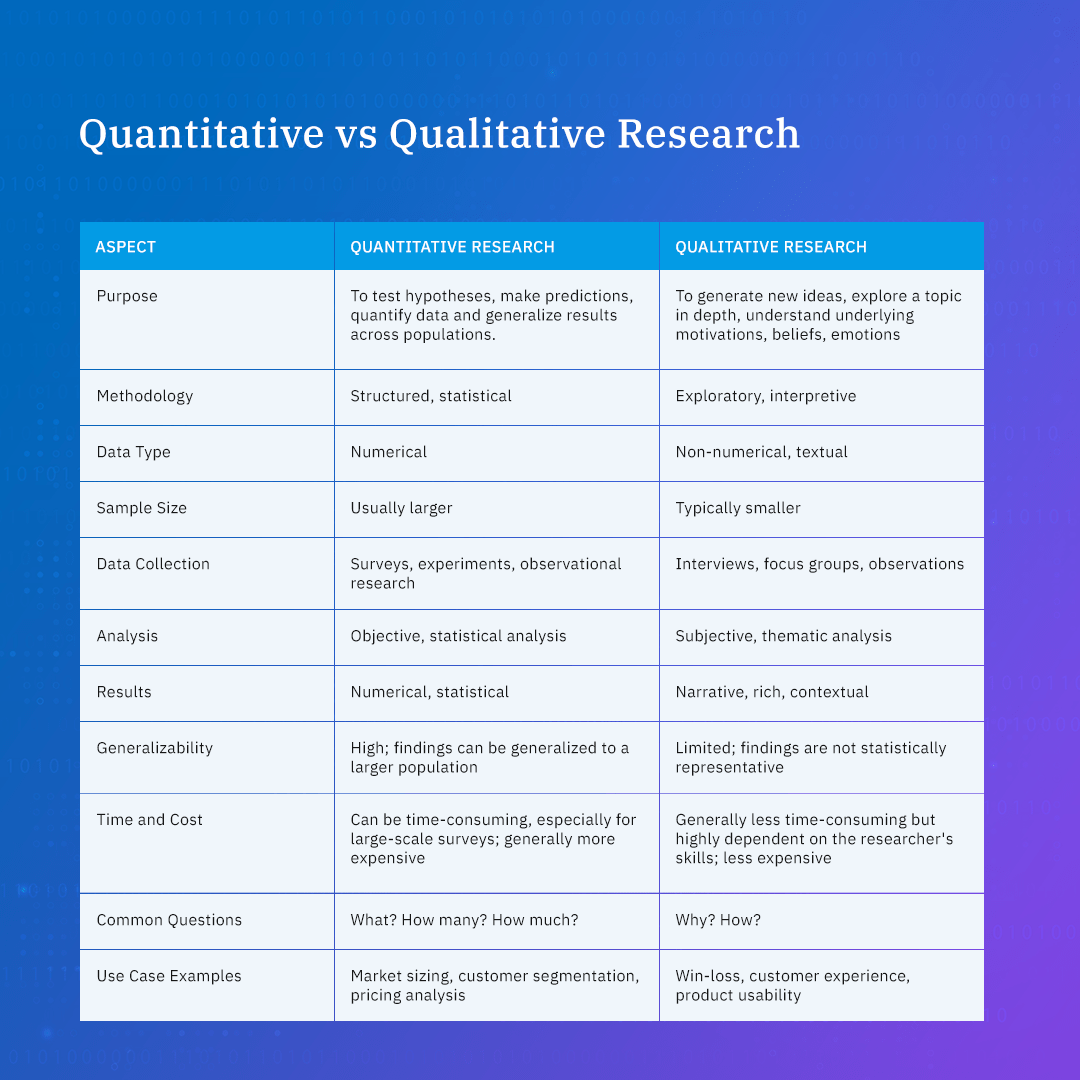

Quantitative vs Qualitative Research

Quantitative research involves collecting numerical data from a large sample of respondents using structured methods such as surveys, experiments, or observational research.

It offers numerical data that can be generalized across larger groups, making it excellent for testing hypotheses and making predictions. It typically applies statistical analysis to interpret results, which makes it good for measuring parameters such as customer satisfaction, purchase intention, brand recall, etc.

Quantitative research can provide a more accurate and generalizable picture of a target market than qualitative research, but it can be less in-depth.

Qualitative research involves collecting non-numerical data from a small sample of respondents using unstructured methods such as interviews or focus groups. It allows you to explore themes such as customer emotions, opinions, attitudes, etc.

Therefore, Qualitative research can provide insights that are difficult to obtain through quantitative research, such as the reasons why consumers buy a particular product or service. It provides rich, contextual insights, but the findings may not be statistically representative of the larger population.

The following table summarizes the key differences between qualitative and quantitative research:

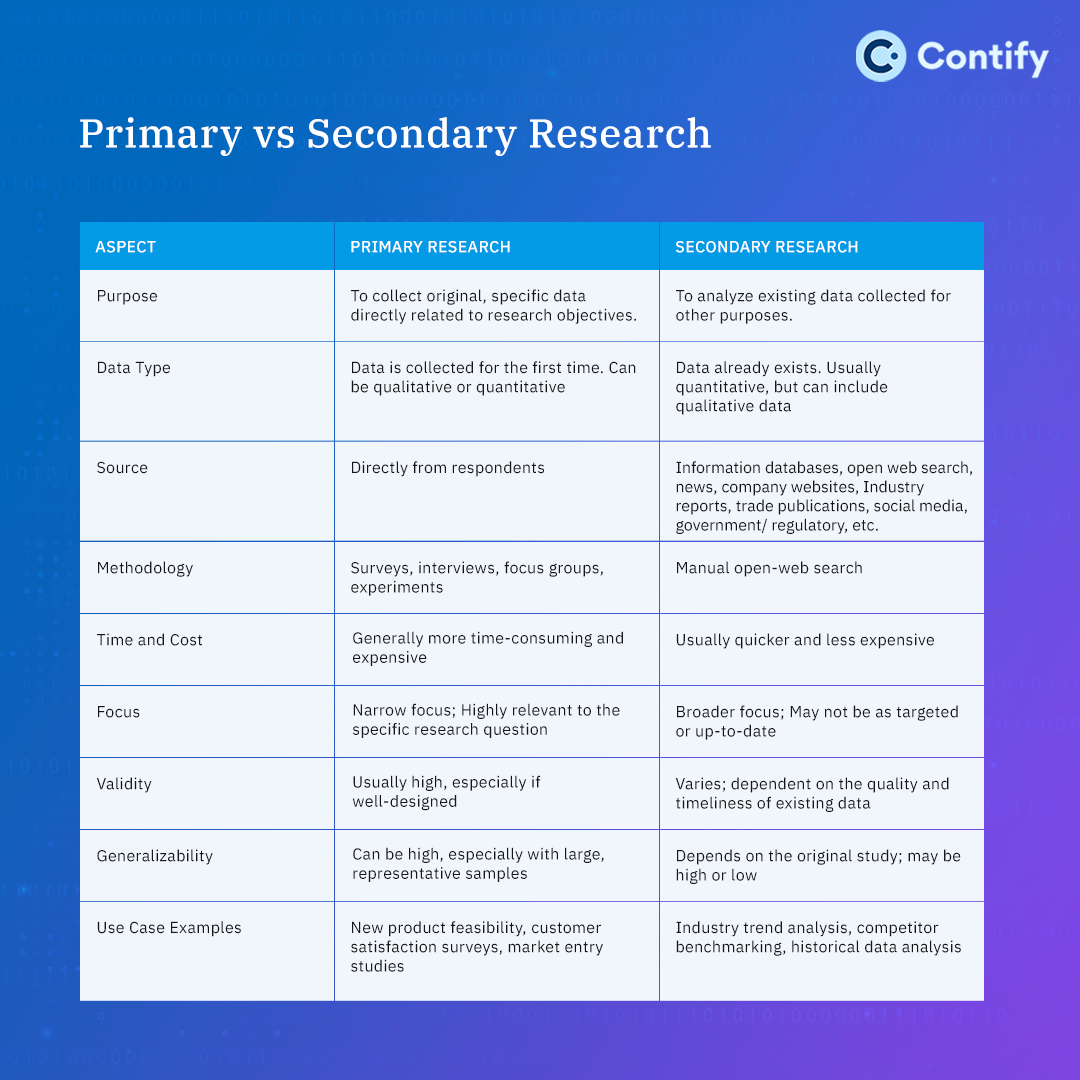

Primary vs Secondary Research

Primary research involves the collection of original data directly from respondents. Primary research is tailored to meet specific research questions and can be either qualitative (e.g., interviews, focus groups) or quantitative (e.g., online surveys, experiments).

While primary research offers more accurate and up-to-date information, it can be time-consuming and expensive than secondary research.

Secondary research, also known as desk research, involves analyzing existing data that is already available in the public domain, such as news, company websites, government data, other research reports, trade journals, etc.

Secondary research is generally quicker and less expensive than primary research but may not be as targeted or up-to-date.

Choosing between qualitative and quantitative research, or primary and secondary research—or a combination of all—depends on various factors such as research objectives, budget, timeline, and the specificity of the information needed.

For a successful Market Research project, you need to be clear about your goals. What do you hope to learn from the research? However, Market Intelligence serves a different purpose than Market Research.

What is Market Intelligence?

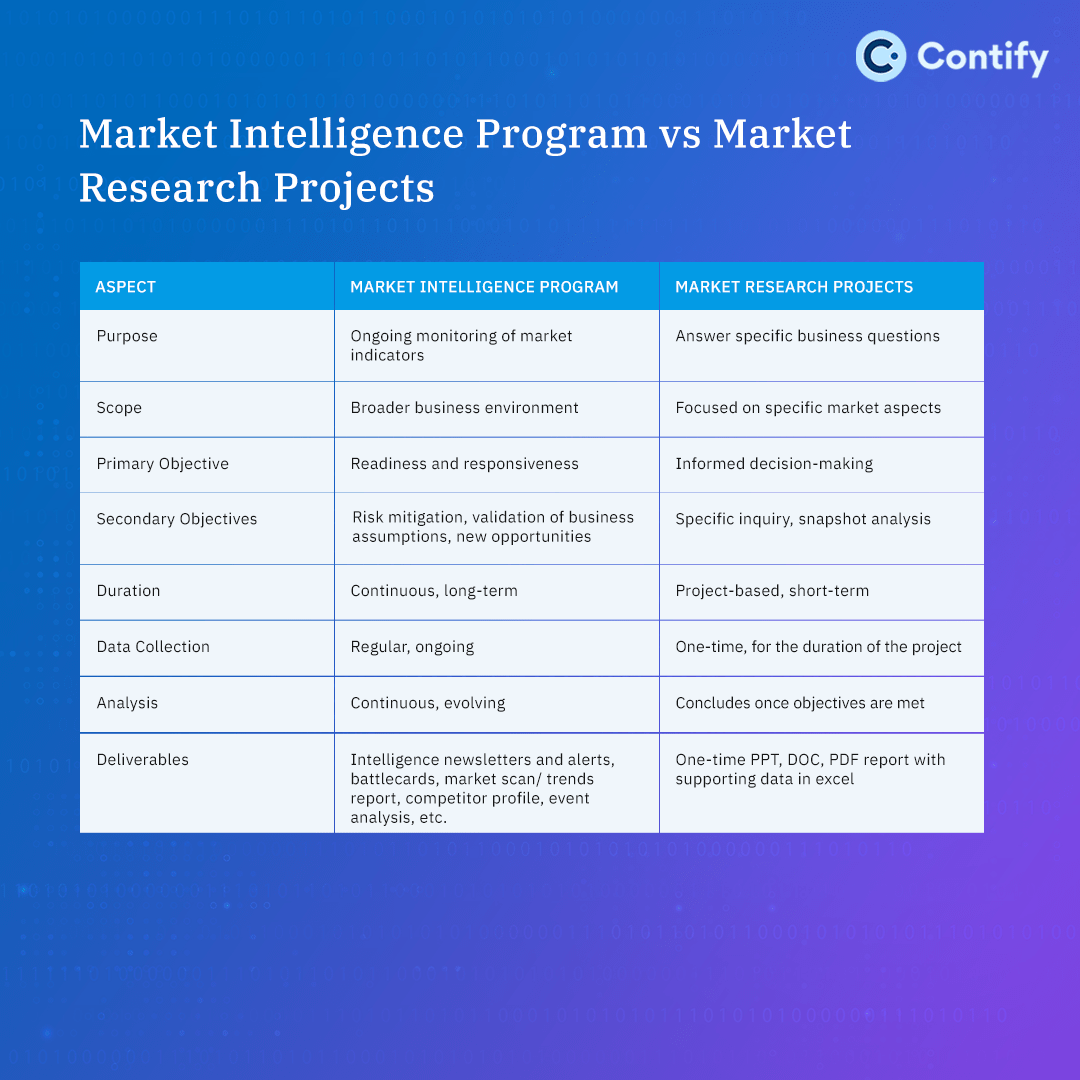

Market intelligence is also about gathering, and analyzing data about markets, customers, competitors, and other market participants, and disseminating it to the stakeholders. But, Market intelligence is NOT about finding an answer to a specific business question. It is about understanding the changes in the business environment that you operate in.

In simpler terms, it’s concerned with “what’s changing”, not “what currently exists.” It is a continuous process — not a one-time project. Rather than a project it is a program— a ‘Market Intelligence (MI) Program.’

When we label it as a “program,” we imply a structured set of activities and processes that are consistently followed. It involves regular data collection, analysis, and reporting. Its purpose is to keep internal stakeholders informed, alert, and ready to act.

While Market Research provides the foundation for making informed business decisions, a Market Intelligence program ensures that the underlying assumptions of those business decisions have not changed. It is like a business’s radar system, constantly scanning the environment to detect weak signals before they become apparent industry trends.

Some of the common objectives for Market Intelligence program include:

– Track activities of the key market participants (competitors, customers, regulators, or suppliers), to spot any changes in their strategies, strengths, and weaknesses.

– Monitor sources and collect data to maintain an ongoing pulse on consumer needs, behavior, preferences; and trigger alerts when any change is detected.

– Continuous market monitoring to identify potential threats and enable your stakeholders to take proactive measures.

– Spot any changes in the market perception/ positioning of competitors’ products

– Highlight any changes in the marketing activities or go-to-market strategy of our competitors

– Monitor shifts in the pricing strategies employed by competitors.

– Capture and analyze early signs of upcoming trends that could either present opportunities or pose threats.

Market Intelligence serves a different yet complementary role to Market Research. The following table summarizes the key differences between the two:

The Value of Integrated Market Intelligence and Market Research

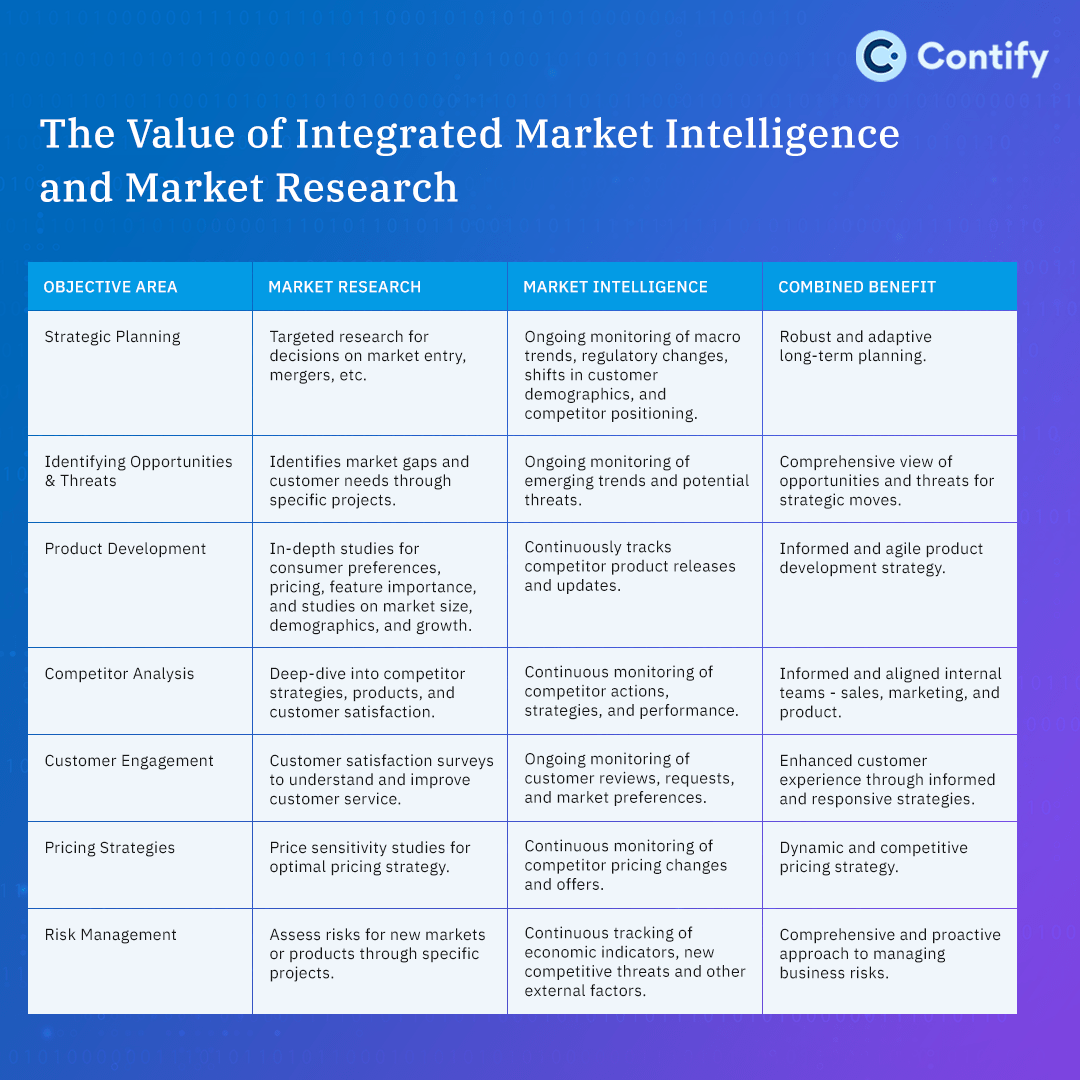

Both Market Research and Market Intelligence have distinct yet complementary roles in helping a company achieve its objectives. Utilizing both allows a company to not only make informed decisions but also adapt and evolve in a continuously changing market landscape.

For example, you can use Market Intelligence to identify a potential gap in the market for a new product or service. Then, you can use Market Research methodologies to test your idea with your target customers and get their feedback.

The table below summarizes how the focused insights from Market Research can be complemented by the broader, real-time insights from Market Intelligence, giving companies a well-rounded strategy for achieving their objectives.

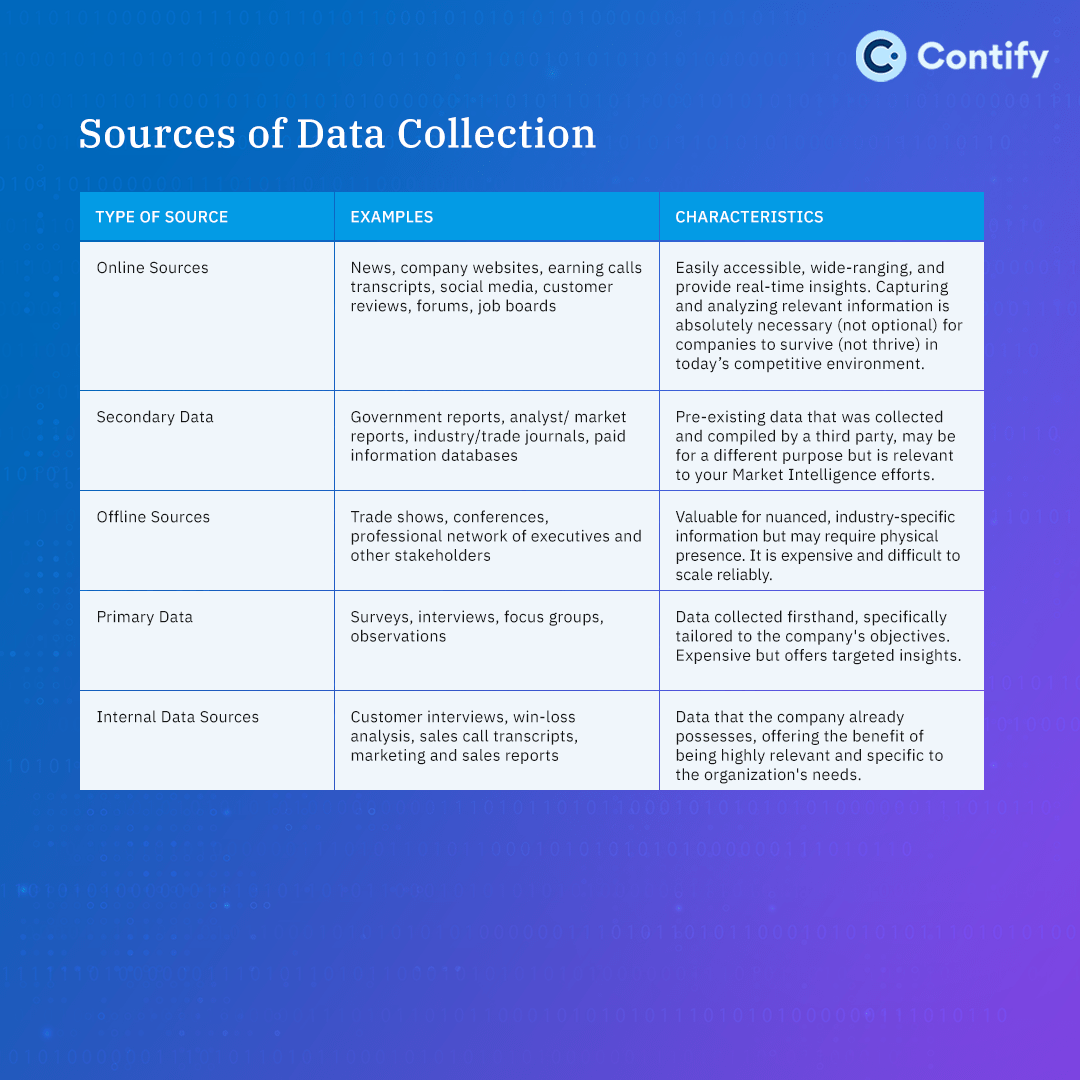

Interestingly, the data used for both Market Research and Market Intelligence often overlaps. The table below outlines the diverse range of sources for data collection, each offering its own unique characteristics.

Leveraging both Market Research and Market Intelligence provides a comprehensive framework for understanding your market, making data-driven decisions, and sustaining a competitive advantage.

The in-depth analysis from Market Research pairs seamlessly with the dynamic, real-time insights from Market Intelligence, equipping companies with a balanced strategy to meet their business objectives.

Contify's Framework for Starting Your Market Intelligence Program

We have established that Market Intelligence is not focused on a specific business question. It is intelligent monitoring of your market landscape for weak signals, changes, and emerging trends.

So, what should be the scope of a Market Intelligence program? It can’t be random monitoring of everything—after all, random actions yield random results.

At Contify, leveraging over 14 years of experience in implementing Market Intelligence programs, we’ve developed a specialized framework to guide companies in outlining the scope of their Market Intelligence initiatives.

Feel free to download our framework to take a more structured approach to your Market Intelligence efforts.

Conclusion

Markets are in constant flux, influenced not just by competitors but also by evolving technology, regulatory shifts, and changing consumer behaviors. While Market Research can answer specific questions, Market Intelligence serves as the company’s radar, continuously scanning a broader spectrum of the business environment.

The absence of a Market Intelligence program in today’s competitive landscape is akin to walking into a shoot-out without a handgun. Traditional approaches to Market Intelligence are not equipped to handle the enormous volume of data available on the internet today.

However, the evolution of technologies like AI, machine learning, and natural language processing has modernized Market Intelligence into a more agile, efficient, and responsive discipline.

Contify is a market and competitive intelligence platform that helps organizations track competitors, customers, and key intelligence topics. It gathers key insights from news, company websites, regulatory portals, and social networks, among other online sources. To know more about the Contify platform, request access here.