An effective Market & Competitive Intelligence (M&CI) program gives you the foundation to compete successfully by providing a 360-degree view of your market, industry, and competition. It enables you to develop the clarity and agility needed to make timely, informed decisions that drive sustained growth.

According to Gartner, over 74% of business leaders acknowledge the need to address market and competitive intelligence challenges within a year. Having an M&CI program is no longer optional—it has become a necessity for organizations that want to thrive in the new hyper-competitive environment.

However, many organizations have been unsuccessful in implementing an effective M&CI program. That’s why we’ve distilled insights learned from serving hundreds of customers over a decade into our latest resource, "2025 Definitive Guide to Setting Up a Winning Market & Competitive Intelligence Program.”

This guide provides actionable strategies, best practices, and a step-by-step approach to help organizations build impactful M&CI programs.

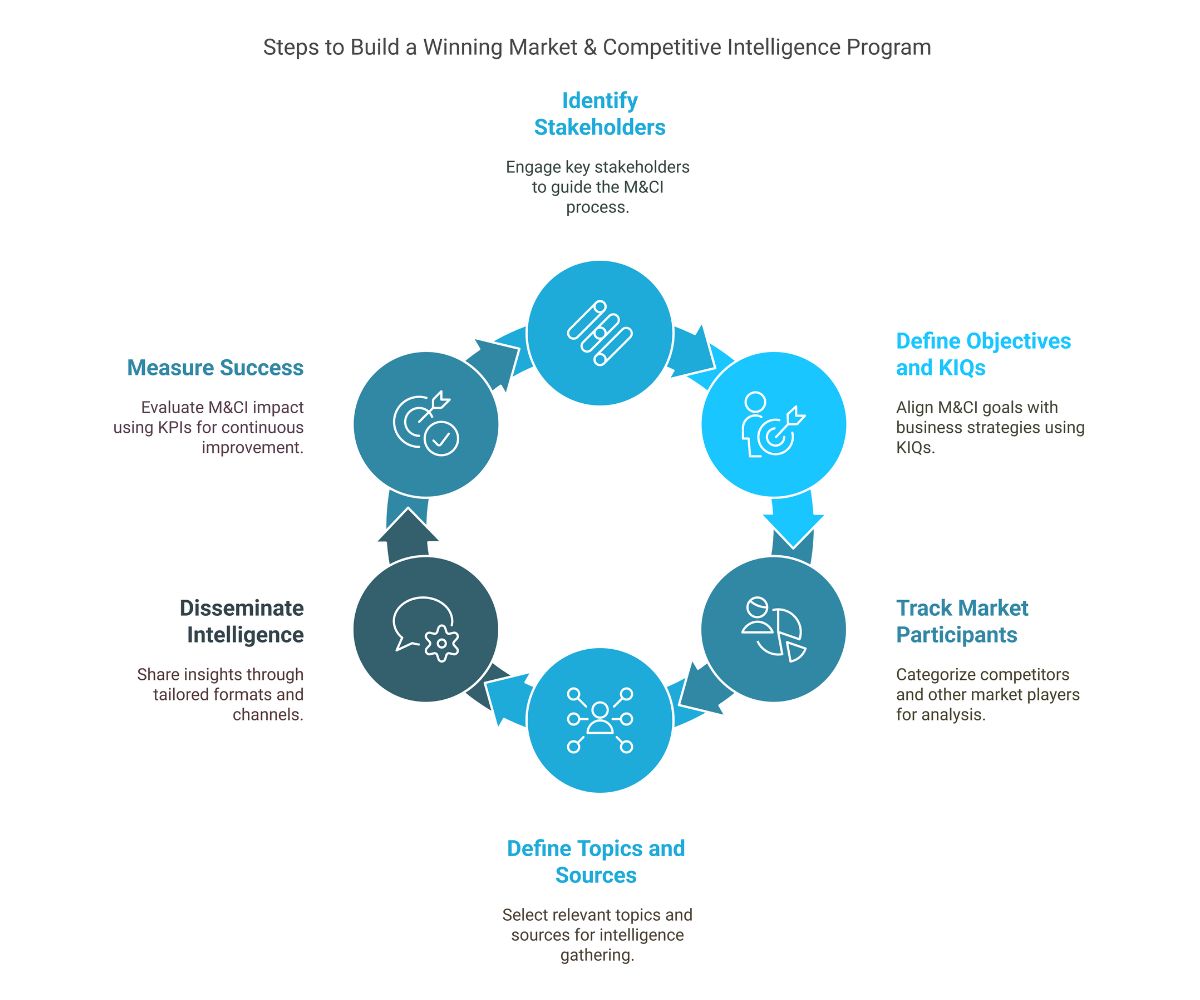

Here is a list of seven key steps drawn from the guide to help you create a high-impact M&CI program that positions your organization for success in 2025 and beyond.

7 Key Steps to Develop a Successful Market & Competitive Intelligence Program

1. Start with ‘Why’ and ‘Who’

The foundation of a successful M&CI program lies in understanding why you need it and who will benefit from it.

Start by determining the stakeholders of your M&CI program, their key objectives, and the decisions they need to make to support those objectives.

Clarity on their goals ensures your program aligns directly with business objectives, setting a strong foundation for impact. Once you know why you need M&CI and who relies on it, you ensure its relevance and buy-in from day one.

By aligning M&CI efforts with organizational goals and stakeholder priorities, you lay the groundwork for success.

2. Develop Key Intelligence Questions (KIQs)

Key Intelligence Questions (KIQs) are the cornerstone of any effective M&CI program. They ensure that efforts remain focused and actionable.

Your stakeholders are absolutely clear about their objectives and decisions to be made, but they wouldn’t know what value you could bring to them through an M&CI program. Therefore, you cannot ask them, “What do you want the M&CI team to find for you?”

KIQs translate these objectives and decisions into specific questions that the M&CI program should help answer. These KIQs are anchors of your M&CI program, which help you generate targeted insights from all the intelligence aggregated from various sources.

Examples of KIQs:

- What are our competitors’ recent strategic moves?

- Which market trends are shaping buyers’ behavior?

- What technologies are emerging in our industry?

By developing and regularly refining your KIQs, you align your program with the evolving market landscape. KIQs are your program’s compass, guiding what you collect, analyze, and deliver.

3. Define the Scope of Your M&CI Program

With KIQs in hand, it’s time to determine the scope of your M&CI program—who and what will you track? And from where?

Typically, the entities to track include:

- Market Participants: Direct competitors, indirect or emerging competitors, customers, partners, suppliers, regulators, influencers, and more.

- Key Intelligence Topics: Beyond specific entities, define Key Intelligence Topics (KITs) aligned with your KIQs—areas like M&A activities, technological disruptions, or new product categories.

Once you know who and what to track, identify where to gather the intelligence for these entities. High-quality insights stem from a mix of internal and external sources. Consider the following:

- External Sources: Company websites, News and PR sites, regulatory portals, social media, online forums, online review platforms, etc.

- Internal Sources: Buyer interactions on conversation intelligence tools (Gong, Chorus, Fireflies, etc.), CRM suites (HubSpot, Salesforce, etc.), Corporate communication tools (Slack, MS Teams, etc.), and field intelligence shared by customer-facing teams.

However, manually tracking all internal and external sources daily is practically impossible. Point solutions like RSS readers or media monitoring tools seem helpful initially, but they often generate excessive noise and fail to unify data.

Instead, a purpose-built M&CI platform aggregates and organizes data automatically, integrates multiple sources (including internal ones), and filters out irrelevant information. This lays the groundwork for timely, context-rich insights that are actionable because they are based on your KIQs.

Being explicit about M&CI scope helps avoid information overload. Without clear boundaries, you risk drowning in irrelevant data. A well-defined scope ensures every piece of intelligence collected contributes to answering your KIQs, keeping your program efficient and outcome-driven.

4. Activate Intelligence for Impactful Decisions

After streamlining the market and competitive data-gathering process, it’s time to turn this data into actionable insights that help your stakeholders make informed strategic decisions.

Start by structuring data (taxonomy) as per your stakeholder’s requirements based on market participants, topics, or other criteria to facilitate analysis. To uncover patterns and implications, use established analysis frameworks like SWOT, PESTLE, or Porter’s Five Forces. If you want to learn about structuring data, refer to our blog series on the art and science of taxonomy development.

In the second phase, you need to process data points and synthesize information in context to your stakeholders’ KIQs. Work towards answering your stakeholders’ KIQs to make M&CI insights actionable for them.

Finally, ensure your M&CI deliverables reach stakeholders in a timely manner and are easily accessible by customizing them to their preferences and delivering them where they are actively consuming information—via emails or communication channels such as Slack, MS Teams, etc.

Role-specific deliverables distributed in a timely manner ensure intelligence isn’t just consumed but also acted upon.

5. Define Relevant Metrics to Measure Success

In order to prove your M&CI program’s value and continuously improve it, defining KPIs is a critical step. Ensure your KPIs are aligned with your business goals and intelligence activities—such as deliverables produced, stakeholder engagement and satisfaction, cost savings, or revenue impact.

Diligently measuring and reviewing these KPIs helps you identify what’s working and where you need to adjust. It also provides evidence to leadership that your M&CI program is a strategic asset for organizational growth.

6. Avoid Common Pitfalls

To avoid unforeseen challenges, be mindful of these common pitfalls that can hinder your M&CI program’s ability to help your organization achieve enterprise-wide decision-making agility:

- Relying on manual processes: This leads to delays, errors, and outdated insights that can’t keep pace with fast-changing markets.

- Neglecting KIQs: Without them, you risk aimlessly collecting data and missing critical insights.

- Focusing solely on competitors: Overlooking customers, suppliers, industry trends, and emerging players narrows your perspective.

- Ignoring internal intelligence sources: Internal data (e.g., sales calls, CRM insights) is a goldmine. Don’t skip it.

- Untimely delivery of insights: Even the best analysis falls flat if delivered too late to influence decisions.

- Choosing unfit tools to support your program: Point solutions that don’t unify data or integrate easily with workflows can cripple effectiveness.

- Absence of metrics to measure success: Without metrics, you can’t prove value or refine your approach.

Recognizing and addressing these pitfalls upfront safeguards your M&CI program’s impact and credibility.

7. Download the Guide

A robust M&CI program equips your organization with the clarity and agility needed to make smarter, faster decisions, ensuring sustained growth in competitive markets.

With a glimpse of these essential steps, you’re well on your way to delivering timely, context-rich insights that empower your organization to stay ahead of the competition, seize new opportunities, and achieve sustainable growth.

Download the full guide now for a deeper dive into these frameworks, practical strategies, and common pitfalls.