Introduction

An increasing number of businesses are making strategic bets on technology to drive growth. AI-powered solutions are at the forefront of this shift, promising smarter decision-making and automation.

This is especially true in Competitive Intelligence (CI). While businesses recognize the need to track competitors, industry shifts, and emerging risks, they also want to ensure their intelligence tools provide real value, not just more data.

Most CI platforms come with standard features like news aggregation, competitor alerts, and market trend analysis. But these features alone aren’t enough to drive strategic decision-making.

In this blog, we’ll explore the essential features that every CI tool should offer and why they matter. Then, we’ll dive into the unique capabilities offered by Contify, helping businesses turn fragmented data into value with 360-degree intelligence.

Competitive Intelligence Features to Ensure You Don’t Miss any Crucial Information

It is important to keep a few things in mind when looking for a CI tool that delivers value to your organization. Here are some necessary features that are core to a well-built CI platform:

1. Monitoring a Wide Range of Public Sources

A strong CI platform should track information from various public sources, such as news websites, regulatory filings, press releases, job postings, etc. Higher coverage increases the ability to detect early signals of competitor moves, market shifts, and emerging trends.

For example, a company preparing to launch a new product can monitor competitor job postings and hiring trends to anticipate potential R&D investments or upcoming feature launches.

2. Ability to Add Primary Intelligence

Primary intelligence refers to information collected firsthand by your organization’s employees. This can be through years of experience, customer feedback, surveys, etc. A good CI tool should allow users to manually input observations, meeting notes, and competitive insights to help enrich automated intelligence with firsthand knowledge.

Imagine your sales team repeatedly hearing from prospects about a competitor’s new pricing model. If you input this data into your CI platform, it would help the decision-makers act on real-world competitive intelligence, not just external data.

3. Data Analysis and Visualization

Raw data provides no value until it can be translated into actionable insights. CI platforms should offer perks like AI-driven analysis, trend identification, and data visualization to help businesses quickly skim through what’s going on in their market.

For instance, instead of just receiving a list of competitor announcements, a smart CI tool should highlight patterns, such as increased funding activity in a particular sector.

4. Pre-Configured Templates for Market Intelligence (MI)

To ensure intelligence is effectively used, CI tools should provide pre-built templates for essential deliverables like:

- Battle cards: Quick-reference guides for sales teams to counter competitor claims

- Dashboards: Centralized views of market trends and competitive movements

- Win-loss analysis: Insights into why deals are won or lost, helping refine strategies

These structured formats help stakeholders quickly consume and apply competitive intelligence without manually compiling reports.

5. Easy Integration with Stakeholder Workflows

One of the core functionalities of CI tools is effectively relaying information to the right stakeholders at the right time. The best platforms integrate seamlessly with CRM systems (like Salesforce), collaboration tools (like Slack or Microsoft Teams), and business intelligence platforms, ensuring siloed information doesn’t hinder crucial tasks.

For example, if a sales rep is about to meet a prospect, they should be able to access a real-time competitor battle card directly within their CRM rather than switching between multiple platforms.

6. Automated Data Tagging

Structuring information is essential for streamlined analysis and intelligence distribution. A well-built CI platform should offer automated data tagging to categorize insights effectively.

Beyond standard tags like Companies, Sources, and Locations, advanced platforms should use intelligent tags such as Business Events, Themes, and Industries. This ensures that relevant insights are easy to find and can be filtered based on strategic priorities.

For example, if a competitor announces a new product launch, the system should automatically tag it under “Product Updates” and “Industry Trends,” making it easier for teams to track related developments.

7. Intelligence Distribution

A strong CI platform should offer multiple ways to disseminate intelligence, including in-platform newsletters, real-time alerts via email, and integrations with communication tools like Slack and Microsoft Teams.

For example, a marketing team may prefer a weekly competitive landscape newsletter, while sales teams might need real-time competitor alerts before meetings. The platform should allow users to create customized newsletters and reports without requiring a paid subscription for every recipient, keeping costs manageable.

Additionally, it should support collaboration, enabling users to add comments or insights directly within newsletters to facilitate discussion and action.

8. Metrics that can be tracked

To measure the success of a CI program, organizations need access to key performance indicators (KPIs). CI platforms often facilitate this by providing analytics on intelligence engagement, such as the number of reports read, insights shared, and feedback received from different teams.

For example, tracking how often sales teams use competitive battle cards can help identify which insights drive the most impact. Similarly, monitoring intelligence consumption trends can highlight which types of content resonate with leadership and decision-makers, ensuring continuous optimization of intelligence efforts.

9. Conversational AI

The ability to quickly access relevant intelligence is crucial, and a Conversational AI feature can significantly enhance usability. A modern CI platform should offer a chat-based interface where users can ask questions and receive instant, contextual answers based on their intelligence database.

For example, instead of manually searching reports, a sales rep could ask, “What are our competitor’s latest product updates?” and receive a concise, AI-generated summary. However, not all AI implementations are equal, some vendors simply integrate generic AI models without ensuring data accuracy.

When evaluating platforms, it’s essential to assess how they maintain reliability, such as grounding AI responses in verified intelligence rather than open-ended AI models prone to errors.

Beyond Competitive Intelligence: Contify’s Unique Approach

While traditional CI tools focus on tracking competitors, Contify enables businesses to take a holistic approach to Market and Competitive Intelligence (M&CI) by monitoring all relevant market forces.

The platform offers some unique features to ensure organizations avoid blind spots and make well-informed strategic decisions.

Keep Track on Non-English Sources

Contify allows you to track your global market landscape and competitors by providing intelligence from 200k+ non-English sources. You can access the original information sources as well, alongside translated intelligence, to ensure you stay fully informed on your worldwide market space. This empowers you to monitor all market forces beyond direct competitors to avoid business blind spots.

Choose the Competitors you Want to Track

The competitive landscape is constantly evolving, and businesses need the flexibility to update their watchlists as new players emerge or priorities shift. Contify enables users to seamlessly add or remove competitors at any time, ensuring intelligence remains relevant. So instead of relying on pre-set competitors, you get to monitor competitors that matter most to them, whether they are direct rivals, disruptive startups, or companies entering adjacent markets.

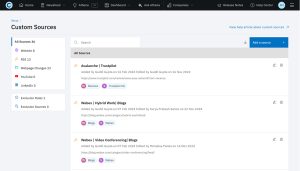

Add Custom Sources and Proprietary Data

While public sources provide valuable insights, some of the most strategic intelligence lies within third-party subscription databases you might have access to. Contify allows you to add on sources and integrate primary information, and paid sources, ensuring a seamless flow of intelligence from proprietary databases, subscription services, and other gated content.

This removes the need to manually scan multiple platforms, saving time while ensuring high-quality intelligence. Contify also lets you manage access to insights within your teams and other stakeholders by controlling who can view modules and knowledge areas.

Get Instant Answers with Ask Athena

Ad-hoc intelligence queries can slow down decision-making. Contify’s Ask Athena solves this by providing instant, conversational AI-powered responses grounded in your organization’s intelligence data. Whether it’s extracting key insights from lengthy documents, answering market-related questions, or searching the open web for additional context, Ask Athena streamlines the research process.

With its seamless integration into Contify’s M&CI platform, Ask Athena enables teams to quickly retrieve relevant insights, reducing manual effort while ensuring accuracy and transparency. This empowers organizations to focus on strategic decisions rather than time-consuming information searches.

Access Archival Data for Deeper Insights

Competitive trends don’t emerge overnight, rather they are built over time. Contify provides three months of historical data on your configured scope by default and can extend access for up to two years with additional plans.

With access to historical intelligence, you get to analyze long-term market shifts, competitor strategies, and industry patterns. This archival data further helps in identifying strategic moves, benchmarking performance, and making data-driven decisions without unnecessary delays.

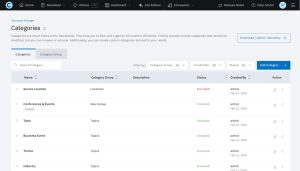

Integrate Organizational Taxonomy to Boost Relevance

Every organization has unique intelligence needs, and generic categorization often falls short. Contify offers a “Taxonomy Manager,” that allows businesses to define their own classifications for events, themes, and entities. This ensures that intelligence is structured in a way that aligns with organizational priorities, making it easier to filter, analyze, and act on insights.

It further ensures that teams like sales, marketing, and research and development can each receive information that is specifically relevant to their needs. For example, Contify’s custom taxonomy enabled a global consulting firm for different use cases, such as tracking executive insights, identifying market shifts, and developing a data-driven positioning strategy.

Gain Actionable Insights Powered by Knowledge Graphs

One of the biggest challenges in intelligence gathering is processing vast amounts of unstructured data. Contify uses Knowledge Graph (KG) principles combined with AI to extract and connect key data points from lengthy articles, reports, and documents.

Instead of sifting through unstructured data, users receive AI-curated insights mapped to their strategic focus areas. For example, a global consulting firm leveraged this capability to track executive insights, identify market shifts, and develop a data-driven positioning strategy, enabling proactive decision-making.

Get Key Updates Instantly with Fact Cards

Staying on top of market changes can be overwhelming, especially when sifting through lengthy articles and press releases. Contify Facts streamlines this process by automatically extracting key data points from unstructured text and organizing them into Fact Cards. These concise summaries capture essential details, such as product launches, partnerships, or industry events, allowing users to quickly grasp critical updates without getting lost in unnecessary information.

Unlock Deeper Intelligence with Automated Insights

Raw data alone isn’t enough, understanding the bigger picture is what drives strategic decisions. Contify’s Automated Insights take intelligence a step further by analyzing multiple Fact Cards to generate meaningful, actionable insights. By connecting related updates and answering Key Intelligence Questions (KIQs), the platform transforms scattered information into clear takeaways, helping businesses make informed decisions with minimal manual effort.

Conclusion

Tracking competitors is no longer just about gathering news and alerts, it’s about deriving strategic intelligence that drives business growth. While essential CI features provide a foundation for competitive monitoring, advanced capabilities like custom source integration, archival data access, and AI-powered insights elevate intelligence programs to the next level.

Contify empowers organizations to go beyond traditional CI by offering a holistic Market and Competitive Intelligence (M&CI) approach. With the ability to track non-English sources, monitor all market forces, integrate proprietary data, and leverage AI-driven analysis, businesses can eliminate blind spots and make informed, forward-looking decisions.

By combining automation with customization, Contify ensures that intelligence is structured, analyzed, and delivered in a way that makes it actionable for every stakeholder.