Why Are Competitor Intelligence Examples Important?

Competitive intelligence or competitor intelligence is the systematic monitoring of your competitors’ actions to determine what they’re doing now, and what they’re likely to do in the future. Competitor intelligence examples, as well as competitive response examples, allow you to tap into the strategies of the organizations which have effectively used them before to their benefit. They allow you to acquire more information and decrease the chances of a piece of intelligence being wrongly applied to real-life situations.

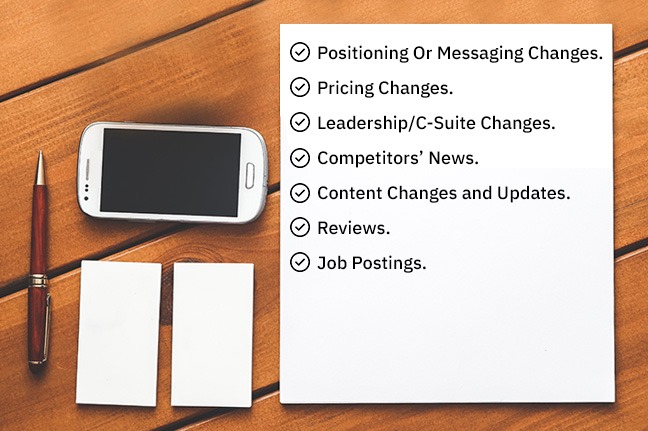

Competitor intelligence allows you to improve tactical execution, guide strategic decision-making, and reveal your relative competitive positioning. Let’s dive into 7 competitive intelligence examples and the intelligence types behind them.

7 Essential Competitive Intelligence Examples

These B2B competitive intelligence examples showcase how companies use competitive intelligence to anticipate competitor moves and stay ahead. Let’s have a look.

1. Positioning Or Messaging Changes

What: Changes in positioning or message of your competitors

Staying on top of such changes will allow you to understand how your competitors are defining and communicating the value of their product or service. This allows you to differentiate your product/service.

Whom: Deliver these insights to your sales, customer service/support, and marketing teams

This allows your sales and customer service teams to counter any objections from prospects/customers, find new talking points, and also address their pain points. These insights are extremely important for your marketing team, as they too will have to make strategic changes in how they position the product, services, and the organization accordingly.

When: Immediately

Deliver insights to Sales, Customer Service, and Marketing teams immediately. The longer you wait, the more likely it is that you get blindsided. Your sales team could lose out on deals, it might get harder for customer service to convince or help customers, and your marketing team might find it harder to counter this move later on. Therefore, it is advisable to deliver competitor intelligence alerts to your teams in the form of monthly reports, daily/weekly newsletters, and instant alerts.

2. Pricing Changes

What: Changes in the pricing of your competitors’ product or service

At times competitors change the pricing of their products or services as a sales promotion. It is a fact that any change in price influences customers, although only short-term, even if you offer a superior product or service. Hence, it is important to keep track of such changes.

Whom: Deliver these insights to your product strategy teams, sales, marketing, and customer service teams

Sales and customer service teams require these insights to counter objections from prospects/customers. They’ll be able to explain your product’s ROI much better if they’re informed. Marketing team needs these insights to build a strategy to better position either the product or the organization to counter the competitors’ move. The product strategy team will use these insights to look for cost optimization opportunities.

When: Immediately

Insights regarding such changes are crucial, and thus, must be communicated to the stakeholders immediately. Pricing changes may indicate competitor’s movement to a new customer segment, and affects the whole organization as it determines the revenue you’re going to earn. Again, intelligence should be delivered in the form of monthly reports, daily/weekly newsletters, and instant alerts.

3. Leadership/C-Suite Changes

What: Changes in your competitor’s leadership/C-suite personnel

The entry or exit of a C-suite executive in your rival organization is top-priority competitor intelligence and signals a strategic shift. It could be an opportunity for you to capitalize upon if a key leader from your rival organization is now out of the game or an incoming threat, if a new leader has entered the fray. Either way, you need to be prepared.

Whom: Deliver insights to the strategy/leadership team enabling them to take the best course of action

What you do with competitive intelligence on leadership changes depends on the situation and requires thorough analysis. If there’s been a new addition to the leadership, let’s say a VP of Sales, you need to aggressively arm your sales team with the intelligence needed to win more deals. A new VP of Sales usually means that he/she is here to drive your competitors’ sales and revenue, and your sales team should be focusing on getting new customers as well as up-selling and cross-selling to existing customers. On the other hand, if there’s been an exit from your competitors’ organizations, let’s say the VP has resigned, this means that either the organization has shifted focus from a particular geography, and it is the time to put your best strategies forward. High-level strategic updates from your organization’s leadership are a must at such times, which is why it is imperative that they – along with your sales teams – receive intelligence in the form of daily updates, newsletters, and alerts.

When: Depends on the situation

In both the situations mentioned above, it is important not to jump to conclusions without proper intelligence. Decisions based on leadership changes in the competitors’ organizations require thorough market research, in addition to some time to strategize. However, make sure you don’t wait so long that you lose the opportunity. When you find the right moment, take action.

4. Competitors’ News

What: Competitor’s news coverage

Tracking competitors’ news coverage can tell you a lot about what’s going on in their organization. Both positive and negative news can help you build strategies, and can serve as talking points for your organization when communicating with clients, customers and prospects.

Whom: Situation-specific

Let’s say your competitor has partnered with another organization to improve their product. This means you’ll have to soon make changes either in your product strategy, or the product itself. On the other hand, negative news like faulty products, salary cuts, or a data breach can be used to your advantage, as proof of your dominance. In the case of the first instance, competitive intelligence needs to be delivered to your leadership and product teams, and in the second instance, every team and stakeholders should be provided with the insights, including product, marketing, sales, and customer success teams, so that they can use it to their function’s benefit.

When: Depends on the situation

Negative news coverage has to be capitalized on immediately, while some thorough thought and foresight will go into devising strategies to counter the positive news. Keep gathering intelligence on your competitor and the market environment until you find the right moment and the right strategy.

5. Content Changes and Updates

What: Changes and updates in competitors’ content, on their website or other online sources

The content on a competitor’s website is your number one source of information on them and can grant a plethora of actionable insights.

Whom: Deliver insights primarily to the marketing team, and if required to the executive and product teams as well

New content is an important piece of competitor intelligence. Changes and updates on the website can inform you of any changes in marketing strategy, their expansion into new customer segments, or any new thought leadership. But a competitors’ website isn’t the only place they share content, and thus you should be tracking any online sources they might be sharing information in the form of blogs, articles, or documents. Your marketing team will have the spotlight on this one. They can leverage these insights to plan their content calendar. The executive team too will have to look out for any updates that might help them ideate a counter-strategy, and act accordingly to maintain your organization’s edge. In case the content is geared towards a new buyer persona, the product team should be involved too.

When: Immediately

New content usually means your competitor is making new marketing strategies or chasing a new customer persona. Getting immediate insights will allow your organization to ramp up a defense of your own. Marketing, leadership, and product teams will have to work in unison to ensure that they don’t let your competitor get a competitive advantage.

6. Reviews

What: Customer and employee reviews of your competitor

Both of these are quality examples of competitor intelligence. They paint a quite precise picture of your competitors’ strengths and weaknesses. Collection and analysis of reviews can also help you identify opportunities and threats early on.

Whom: Deliver the insights to all the stakeholders in your organization

Review sites like G2, Glassdoor, or Trustpilot are goldmines of competitive intelligence insights on customer satisfaction, product flaws, and company culture. By tracking what the customers and the organization’s employees are saying about the company, you gain access to all the information that the organization isn’t sharing of their own accord. This information is useful to all your teams, especially the executive and product management, as they can incorporate this intel into their long-term plans, and create a much better product as well as user experience. Leadership can also improve the employee experience. Marketing and sales teams can incorporate this information into their content and conversations respectively to gain a competitive advantage.

When: As soon as possible

Creating a better product and user experience, improving the employee experience, and creating new content takes time. Thus, there’s no time like the present to begin using insights from customer and employee reviews.

7. Job Postings

What: Job postings by the competitors on various job portals

Job postings tell you which human resource your competitor is looking to invest in. It also tells you what they require, and hence are focusing on.

Whom: Deliver information to the team associated with resource the competitor is looking for

Depending on which resources your competitor is hiring, you can predict their motive and direction through further analysis of information. This allows you to carry out a strategic counter-move of your own. For example, if your competitor is looking for a social media marketer, it’s clear they are trying to boost their marketing, and thus your marketing team must up the ante as well. Similarly, if they’re looking for a sales trainer, they wish to improve their sales and win more deals. Thus, your sales teams should be ready for this. Ensure that they are receiving monthly reports, daily/weekly newsletters, and instant alerts to be aware of all these valuable insights.

When: Not immediately, but soon

You never know when that job posting might turn into an actual hire. Thus, you should deliver the insights soon to the concerned team or teams, so that they can be prepared. Starting as early as possible will ensure that when the resource gets hired, you’ve already bolstered up to negate any competitive advantage they might bring to your competition.

How To Use Competitive Intelligence To Your Advantage?

These types of competitive intelligence with examples show the diversity of insights you can track. But how do you actually turn this information into strategy? Here’s a step-by-step look at the competitive intelligence process:

Download M&CI Process Template

1. Discover Your Target Market

Competitive intelligence isn’t just information and insights about your competitors. It also includes information like market size, market growth, territories in operation as well as customers/demographics. This is why competitive intelligence and market intelligence always go together. Information about your market is something that should be tracked at the bare minimum. This is the first step in the competitive intelligence process.

2. Discover Other Products and Their Pricing in Your Target Market

Any other products in your target market are your direct or indirect competition. Gathering competitive intelligence on these products is vital for product benchmarking, pricing strategy, and competitive positioning. Find any gaps in your product, help with R&D, in positioning your product as well as in deciding its pricing. Keep a spreadsheet of all products in your target market and their pricing handy.

3. Discover Competitors in Your Target Market

You probably have a good idea of who your competitors are, and the third step in the competitive intelligence process is to constantly monitor them. You should also be on the lookout for new or emerging competitors. Gather intelligence on competitors through various channels such as news, press releases, their websites, social media, content campaigns, and promotions among others mentioned before.

Competitive intelligence tools are also a great way of tracking existing and emerging competitors as they enable you to monitor their press releases, content strategies, web activity, and social media.

4. Benchmark Yourself

The fourth step in this process is to benchmark yourself alongside competitors. You’ll have to create various competitive analysis graphs and matrices to do that. This will offer benefits such as:

– Identify areas you need to improve to compete and grow.

– Highlighting issues from drops in your performance not in line with market conditions.

– Spotting drops in performance from competitors that you can take advantage of.

– Identifying trends so that you can quickly move on.

– Being aware of any competition moving on your position and quickly take action.

Download competitive analysis template

5. Form A Strategy Using the Intel You’ve Gathered

The final step in the competitive intelligence process is to utilize all aggregated information to formulate various organizational strategies. The various stakeholders in your organization will be responsible for using the gathered data to determine the best course of action for their respective functions. Large multinational corporations usually have full teams of competitive intelligence professionals and internal CI programs which constantly help every stakeholder make informed decisions. However, market and competitive intelligence platforms like Contify automate this process, providing near-real-time competitive alerts, curated dashboards, and department-specific insights.

Conclusion

Using competitive intelligence effectively to stay ahead of the competition requires an organization to act strategically as one unit. Competitive intelligence is useless if it’s not communicated properly organization-wide as per need. The focus or keyword here is communication. A competitive and market intelligence software like Contify can be of tremendous help here, as it can integrate into your organization’s CMS, or sales-enablement tools, providing insights in the form of email alerts, notifications, reports, and other such formats.

This is more likely to involve various stakeholders of your organization such as sales, marketing, product management, customer success, and executive leadership in your competitive intelligence program, giving you a sustained competitive advantage. Whether you’re in sales, marketing, product, or leadership, these competitive intelligence program examples are your blueprint for sustained success.

Frequently asked questions

What are examples of competitive intelligence in business?

Examples include tracking competitor pricing changes, monitoring leadership hires or exits, analyzing product updates, collecting customer reviews, and evaluating content or messaging shifts. These competitive intelligence examples help businesses understand market positioning, identify threats, and uncover growth opportunities.

How can real-time competitive intelligence improve decision-making?

Real-time competitive intelligence allows businesses to respond quickly to market movements. Whether it’s a competitor launching a new feature, changing pricing, or expanding into a new market, having immediate visibility enables faster, more informed decisions across sales, marketing, product, and strategy teams. It also helps organizations avoid being blindsided by sudden competitor actions.

Which departments benefit the most from CI insights?

Sales, marketing, product management, executive leadership, and customer success teams all benefit significantly. Sales teams use competitive insights to refine pitches; marketing teams align campaigns based on competitor messaging; product teams enhance roadmaps with real-time updates; and leadership uses competitive intelligence analysis to shape strategic direction.

What tools can help track competitor activity in real time?

There are various competitive intelligence platforms and tools such as Contify, Crayon, Klue, and Similarweb that provide real-time tracking of competitor websites, content, pricing, job postings, news, and more. These tools often include dashboards, automated alerts, and integration with CRM and marketing automation systems.