Most investors do their industry research and competitive benchmarking well before deciding to invest. But to be on the board of a company and perform their duties with full responsibility, they need to be fully aware of the changing market and competitive landscape of their investee companies. Actively tracking and monitoring the competitive landscape of the investee companies helps not only to actively support the companies, but also minimizes the risk of the investment.

Investors need to regularly monitor the market landscape of their portfolio companies, so as to understand how they’ll be affected by external market factors. Specialized competitive intelligence on portfolio companies, which is sometimes called investment intelligence, is a prudent way to do this. In this article, let us delve further into investment intelligence, and understand how it helps to safeguard the investment in portfolio companies.

What should investment firms be tracking?

At the very least, investment firms such as venture capitalists (VCs) and private equity (PE) firms, at the very least, need to track the following topics related to the competitors and companies they’ve invested in:

– Negative News

– M&A Activities

– Funding Activities

– Corporate Restructuring

– Management Changes

– Partnership & Alliances

– New Offerings

– Procurement and Sales

– Business Expansion

– Announcements/Rumours

– Financial Results

– Bankruptcy

– Cost Cutting

– Operational Challenges

Tracking portfolio companies and their competitors in this manner will make it possible for investors to gain insights into the competitive landscape, while also helping the companies in developing effective business strategies, thus playing the role of a responsible and effective board member.

How to collect investment intelligence?

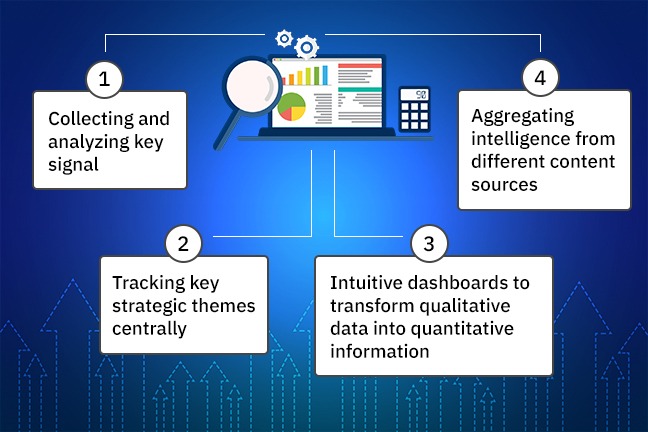

Investment firms collect intelligence in the initial stages of the investment with the help of analysts who use information databases or primary research vendors. However, after the investment, most firms lack a structured intelligence gathering process. To collect relevant investment intelligence investors can leverage a market and competitive intelligence platform that fulfills the following requirements:

Collecting and analyzing key signals

Key signals of impending risks or opportunities can be spotted via client interactions, social media, survey data, fund performance data, portfolio composition, performance and volatility among others. Thematic insights (e.g. ESG, FinTech, and regulations) provide a focused view on emerging trends and their impact on companies similar to your investees, as well as the behaviour of similar investment firms in the same domains. Combining these can help perform a comprehensive competitive analysis that can help design differentiated investment strategies.

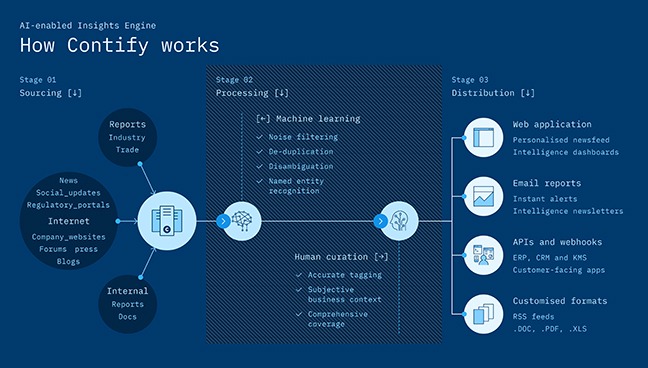

An effective marketing & competitive intelligence (M&CI) platform can help achieve this by creating ‘a single source of truth’ for all board members, which integrates all research and intelligence initiatives, as well as insights generated.Here’s an example of how an AI-powered Market and Competitive Intelligence platform works.

Tracking key strategic themes centrally

Several secular themes like ESG/Sustainability, Fintech, product innovation and regulatory developments are continuously affecting the marketplace. It is critical for investors to keep track of any developments so they can provide guidance to their portfolio companies to act quickly. This requires tracking a number of sources of information on a near real-time basis, analyzing unstructured information to identify actionable insights, and disseminating these insights in an intuitive format.

Thus, investors require an M&CI platform that can integrate and compile data from a number of sources and disseminate insights as per the needs of specific business functions, including news alerts on critical events, in-depth analysis on specific topics, and interactive dashboards to identify and analyze trends over time. This will enable investors and their teams to anticipate and act upon potentially disruptive forces.

Intuitive dashboards to transform qualitative data into quantitative information

Some of the datasets collected from news, company websites, job boards, etc. are qualitative in nature, and can provide in-depth insights. However, such qualitative data is usually unstructured that is not only difficult to process, but also difficult to analyze. As a result, the insights are lost in data.

Thus, a market and competitive intelligence platform that can enable an investor to transform such datasets of qualitative content into easily digestible intuitive dashboards, is required. It will allow the investor to break down and analyze the market trends.

Aggregating intelligence from different content sources

Market and competitive intelligence for investors may be contained in several content sources such as:

– News Articles

– Regulatory Filings

– Social Updates

– Marketing Resources

– Press Releases

– Podcasts

– Presentations

– Dashboards

– Spreadsheets

– News feeds

– Syndicated research by research vendors

Such intelligence may reside in different silos, and thus a significant proportion of intelligence may not be easily accessible on time. A market and competitive intelligence platform that can aggregate all these content formats centrally, enables investors to have a 360° view of the industry, competitors, and consumers, and thus, can enhance investment decisions.

Request a seven-day free trial of Contify’s Market and Competitive Intelligence Platform below:

Conclusion

Professional investors like VCs and PE firms usually have a common goal, apart from making profit (or at least they should), which is being responsible board members and helping the leadership of their portfolio companies with strategic guidance. This is where a market and competitive intelligence platform can come in handy, providing investors with information that isn’t usually used when considering business strategies. They can ignite more creative, strategic thinking and informed decision-making, while allowing investment firms to deepen their understanding of known areas as well as explore new areas for continued investment success.

Market and competitive intelligence tools can automate numerous tasks related to data collection and analysis, providing investors with easy-to-understand trends and patterns. These advances allow investment firms to spend less time on time-consuming tasks, minimize errors, as well as strengthen and improve their portfolio companies.