This blog delves into each step of establishing a strategic M&CI framework to align your M&CI program with overarching business goals.

At the end of the blog, you can download Contify’s 2025 Market & Competitive Intelligence Process Template to adopt this framework for your M&CI program. Let’s begin!

Identify Your Stakeholders

This is the default and easiest step in the M&CI process. Usually, an intelligence program is sponsored by the executive leadership team or a leadership team member with significant authority and budget.

This team or person is your key stakeholder, and they will also help you identify the other stakeholders or consumers of the M&CI deliverables. Stakeholders could span various departments, each with distinct needs and strategic focus.

For example:

Leadership/Executive Team: They are responsible for the strategic decisions for the organization, such as product planning and investment decisions, establish strategic partnerships, identifying opportunities, and preparing for threats.

Marketing: Requires intelligence on competitors’ marketing strategies, emerging market trends, and customer preferences. This information aids in developing impactful marketing campaigns and differentiating the brand.

Sales: Focuses on gaining competitive intelligence that improves sales conversion rates and sharpens sales tactics, needing insights on competitors’ products, pricing, and customer feedback.

Product Development: Looks for intelligence on market trends, customer needs, and technological advancements to innovate and update the product line-up.

Identify MCI Objectives and Map Them to Key Intelligence Questions (KIQs)

The foundation of an effective Market & Competitive Intelligence (M&CI) program is rooted in its alignment with a company’s stakeholders and their strategic objectives. The key to this alignment is to frame the right Key Intelligence Questions (KIQs).

“The answers are all out there, we just need to ask the right questions” — Oscar Wilde.

KIQs act as a compass that guides the M&CI programs in sync with the business objectives. They direct the intelligence program to focus on gathering information that does not just sound interesting or look important — but is actionable!

This distinction is vital; any information that does not contribute to answering a KIQ is just information, not actionable intelligence.

Here are a few sample KIQs:

– Who are the new competitors in our market landscape?

– What features are being highlighted in competitors’ new product releases, and how do they compare with our upcoming product’s features?

– How has competitors’ customer acquisition cost trended over the past year in the Asian-Pacific markets compared to ours?

– What are the latest technology trends/ disruptions in our market landscape?

– What are the emerging needs of our customers?

These KIQs provide a lens to view and filter the information. They are designed to process the information to pinpoint insights that can support a business decision.

KIQs are not supposed to be static. These should be regularly reviewed with the internal stakeholders and updated to remain relevant in constantly evolving market conditions.

Relevant KIQs are essential to ensure your M&CI program remains relevant in the changing market landscape, thereby maintaining its strategic relevance and effectiveness for your stakeholders.

Identify market participants to track

Depending on your internal stakeholders and KIQs, you should identify relevant market participants and categorize them for easy analysis.

All competitors are not equal. You should categorize them to develop a granular understanding of the market landscape.

– Direct Competitors: These are competitors offering products or services that are essentially the same as yours. They target the same customer base and fulfill the same needs.

– Indirect Competitors: These competitors offer products or services that are not the same but could satisfy the same customer need or solve the same problem.

– Emerging Competitors: These are new entrants in the market who may not pose an immediate threat but have the potential to become significant players.

– Niche Competitors: These competitors specialize in a particular market segment and may have a stronghold in that niche.

– Regional Competitors: Competitors who operate only in certain geographical areas, which might overlap with your market.

Understanding competition is important; however, an in-depth understanding of a market landscape goes beyond mere listing competitors. You need to identify and understand other market participants, such as:

– Key Customers: Your major clients who significantly contribute to your revenue. They can include both long-standing customers and high-potential new clients.

– Strategic Partners: Entities with whom you form alliances or partnerships. These can be other businesses, academic institutions, or research organizations that complement or enhance your offerings.

– Suppliers and Vendors: Companies that supply you with necessary goods or services. Your dependency on them and their industry position can significantly impact your business.

– Regulators and Governing Bodies: Government and regulatory agencies that enforce laws and regulations affecting your industry.

Industry Thought Leaders and Influencers: Individuals or organizations that shape industry trends, standards, and best practices. They can influence customer preferences and industry direction.

– Investors and Financial Stakeholders: Entities that provide capital or have a financial stake in your company.

– Distributors and Retailers: Channels through which your products reach the market. They play a crucial role in your product’s market presence and accessibility.

– Trade Associations and Industry Groups: Organizations that represent the collective interests of companies within your industry, often providing resources, networking opportunities, and lobbying efforts.

Monitoring these players for strategic developments is critical in developing a comprehensive competitive strategy and navigating the market effectively.

Define intelligence topics and sources

Next, we must define the primary topics and sources for your intelligence gathering. This step ensures that the intelligence you collect is related to the KIQs our program should support in answering.

1. Focus Areas: Define the industry segment, markets, and geographies our program must focus on. For instance, you might concentrate on payment technologies for international transactions.

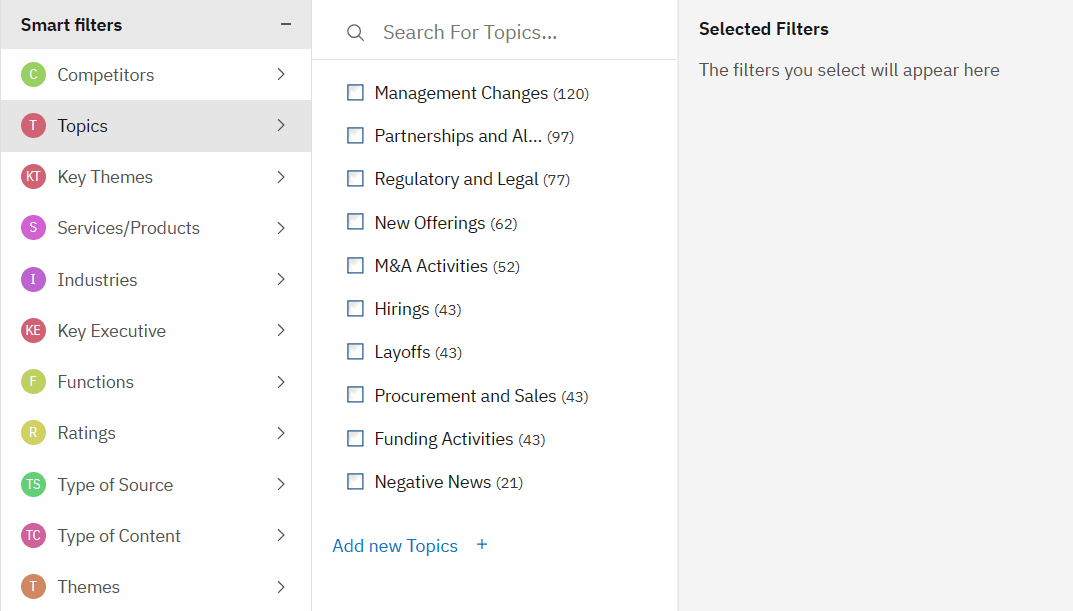

2. Topics: Then, identify specific topics and business themes to track. These could include M&A Activities, Business Expansion, New Products/Services, or emerging technologies related to your focus areas.

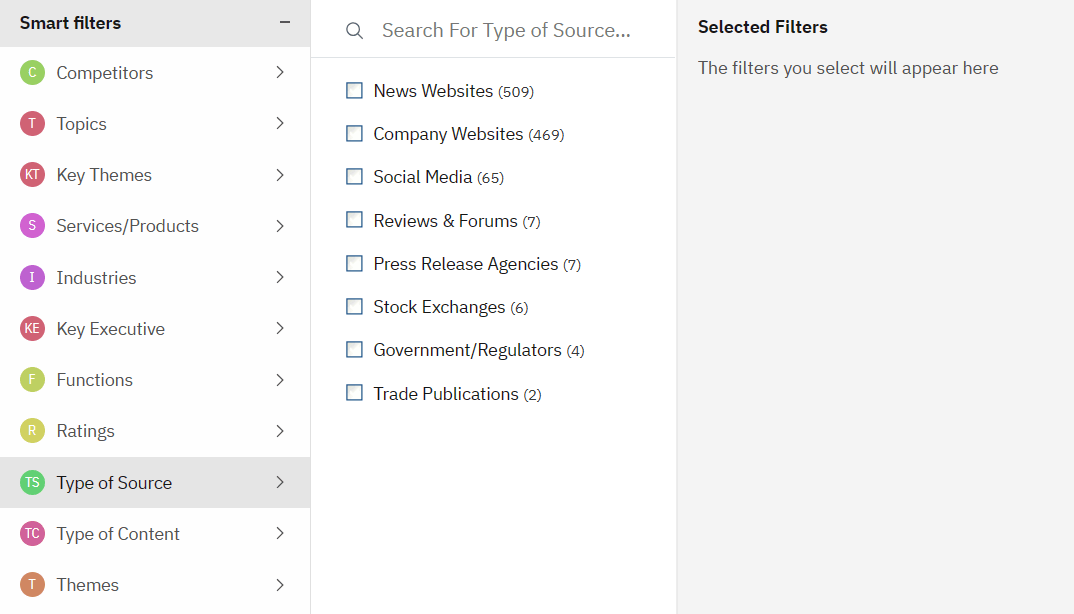

3. Sources: Decide the key sources from which you should collect information. These might include a competitor or regulator website, a stock exchange, a niche industry trade publication, or the Twitter handle of a thought leader.

More importantly, you should include information from internal sources such as CRM, Knowledge Management, or Slack/ MS Teams channels. It’s crucial to specify particular competitors or platforms to monitor. Learn how you can add custom sources in the Contify platform.

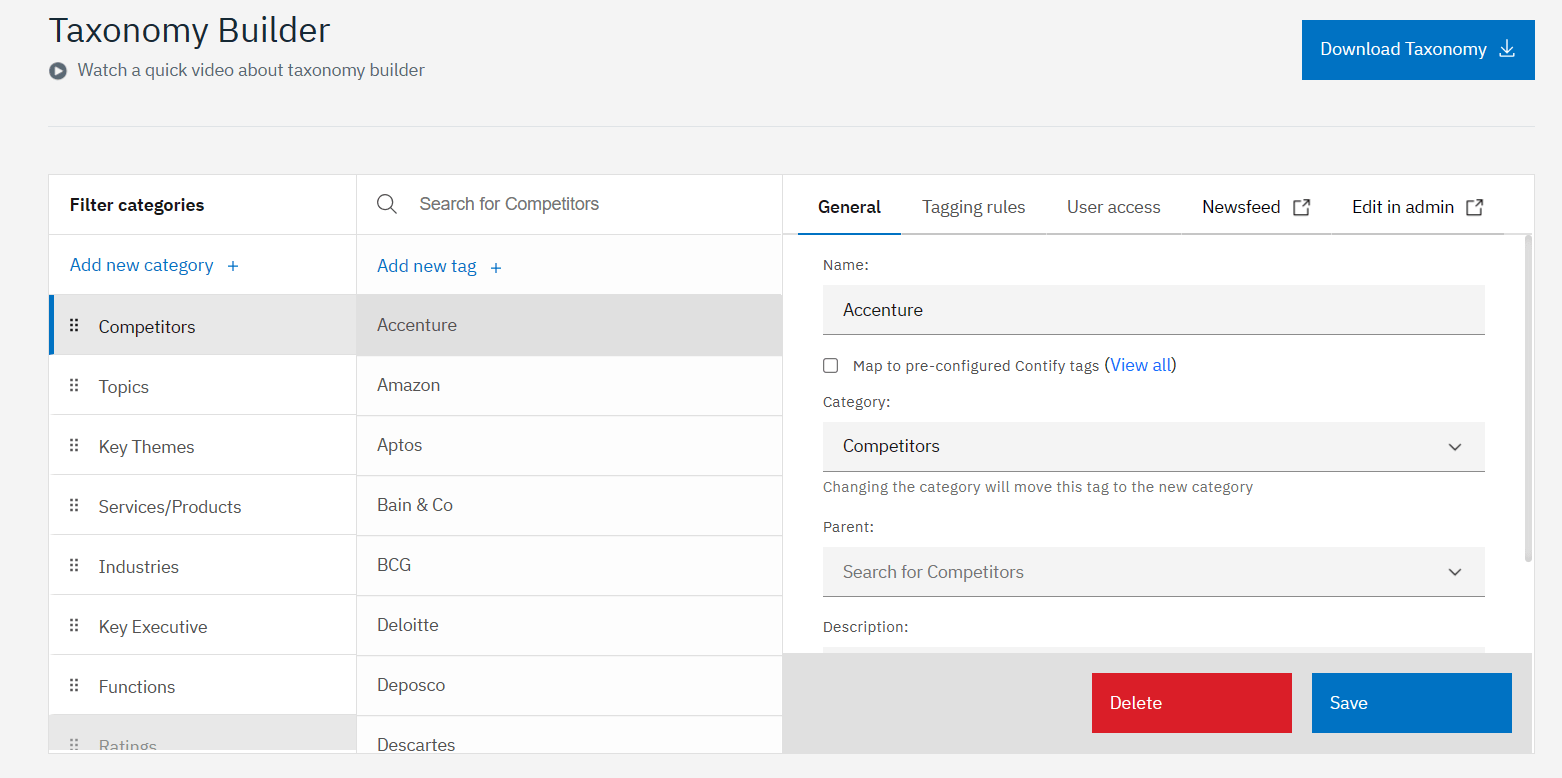

4. Taxonomy: To structure your intelligence-gathering framework, you need to create a taxonomy. This will guide how the information should be tagged and structured so that the information can be analyzed to drive insights that are aligned with KIQs. Learn more about taxonomies here.

5. M&CI Platform: A specialized market and competitive intelligence platform plays a pivotal role in efficiently gathering and managing this intelligence. It should offer custom sourcing capabilities and the ability to create your taxonomy, allowing you to tailor your intelligence gathering to your specific needs and focus areas.

Watch an interactive demo of the Contify platform.

Identify formats and modes for disseminating intelligence

The choice of formats and modes for dissemination is crucial in ensuring that the intelligence is actionable and reaches the right audience at the right time.

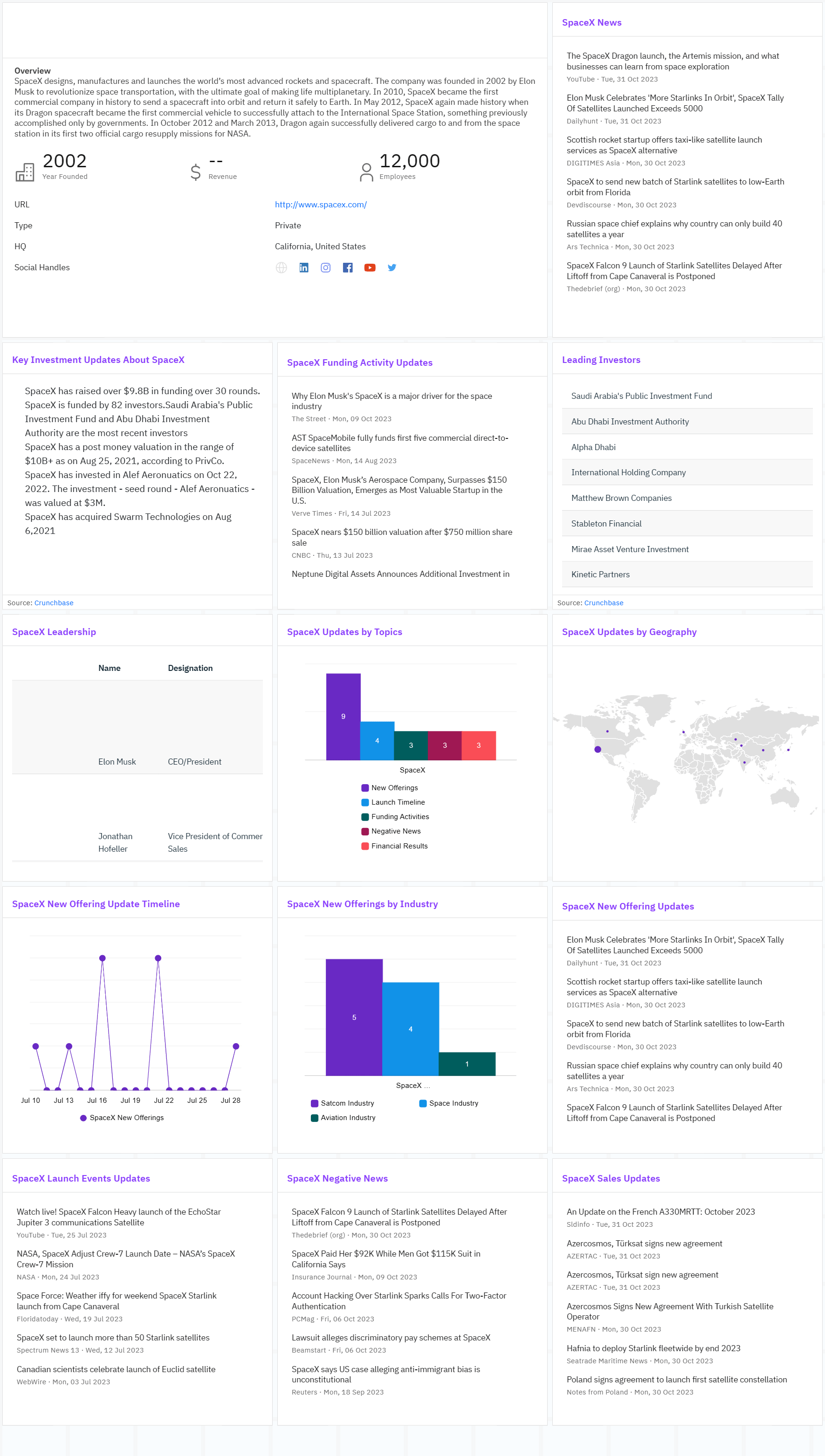

– Formats for Customizing Intelligence: Your format for dissemination intelligence should be governed by your stakeholders. You can use formats such as intelligence newsletters, battlecards, competitor profiles, market landscape reports, competitive analysis reports, and win-loss analysis, presented on always-updated dashboards.

Each format serves a specific purpose and audience, from quick updates on newsletters to detailed analysis on dashboards and intelligence reports.

– Modes of Dissemination: The intelligence can be distributed through various channels, including Newsletters/Email Alerts, Corporate Communication Channels like Slack or MS Teams, and CRM or Knowledge Management Portals.

Each channel has its strengths in terms of reach and engagement. However, the best option would be an M&CI Platform that integrates with all the channels mentioned above and acts as a single source of truth (SSOT) for the entire organization.

– Dissemination Frequency: Establish a dissemination frequency that aligns with the urgency and relevance of the intelligence.

For example, Newsletters might be circulated weekly, Email Alerts can be sent in real-time, and Dashboards can be updated daily.

This frequency ensures that stakeholders receive timely updates, enabling them to make informed decisions.

By thoughtfully selecting the appropriate formats and modes and scheduling the dissemination of intelligence, you ensure that each segment of your organization receives the right information at the right time.

Establish metrics to measure the success of your M&CI program

The success of a Market & Competitive Intelligence (M&CI) process should be established with measurable outcomes.

To accurately gauge its value, it’s essential to move beyond anecdotal evidence and establish concrete metrics, or Key Performance Indicators (KPIs), that reflect the program’s impact.

– Engagement: This KPI measures how users interact with the intelligence provided. It includes metrics such as user engagement with intelligence reports, frequency of access, and feedback on the utility of the information.

– Relevance: Assessing the pertinence and actionability of the gathered intelligence is crucial. This involves determining whether the intelligence aligns with the stakeholder’s needs and contributes to informed decision-making processes.

– Impact: Evaluate the influence of M&CI on business outcomes. This could be reflected in tangible changes such as improved win rates, increased market share, or strategic shifts prompted by the intelligence.

By regularly monitoring these KPIs, you gain valuable insights into the efficacy of your M&CI process. This justifies the investment in M&CI and guides continuous improvement in your intelligence strategies.

Regularly assessing engagement, relevance, and impact ensures that the M&CI program remains aligned with organizational goals and adapts effectively to changing market dynamics.

Conclusion

Each step outlined above provides a structured approach to building a robust M&CI process. By following these guidelines, organizations can create a system that not only gathers intelligence but also translates it into actionable inputs.

For professionals looking to streamline their M&CI process, we have crafted the 2024 Market & Competitive Intelligence Process Template for Strategic Business Alignment.

This template is designed to help you align your M&CI efforts with business objectives, ensuring that every piece of intelligence you gather contributes to your strategic goals.

________________________________________________________________________________________________________________________________________________________________________________

Interested in optimizing your M&CI process for maximum impact? The Contify M&CI platform embodies these principles in its core design.

Its features collectively empower users to seamlessly integrate and leverage tailored intelligence in their strategic decision-making process, reflecting the essence of a well-orchestrated M&CI strategy.

Take a 7-day free trial of the Contify M&CI platform and experience it yourself.