Today, it is less than 18 years. By 2027, it's projected that 75% of today's S&P 500 enterprises will no longer exist.

A well-planned market and competitive intelligence (M&CI) program is essential to navigate this volatile business environment. At its core, an M&CI program involves the systematic monitoring of competitors and market players – a process crucial for staying informed about current actions and forecasting future moves.

It empowers companies to not only foresee upcoming market changes but also adapt their strategies with agility and precision. It's about being one step ahead of the competition, understanding how the market might evolve, and preparing to pivot or innovate as necessary.

Yet, merely establishing a competitive intelligence program does not guarantee success. We need to know how to use it effectively. But how to use it effectively?

Learn from other competitive intelligence professionals

Understanding how competitive intelligence is applied by successful M&CI professionals is essential to laying the foundations of your competitive intelligence program.

For instance, how are other sales teams leveraging it to beat their competition? How are marketing teams adjusting messaging that resonates with their ideal customer profiles? How are product teams using it to position their offerings and to develop a differentiated product roadmap? How are leadership teams using it to get an updated picture of their competitive landscape to make intelligent business decisions?

Many parameters go into making an M&CI program successful. Any information about competitors is not competitive intelligence unless it can be applied in decision-making.

Before delivering competitive intelligence, you must understand the key decisions your stakeholders need to make. Then, frame those decisions as key intelligence questions (KIQs). Successful M&CI professionals are clear about the KIQs of their stakeholders. These KIQs provide a filter to process the information, cut out the “noise” and provide competitive insights related to specific decisions.

Successful M&CI professionals are good at picking up weak signals and developing hypotheses, and have a systematic mechanism to validate those hypotheses.

8 Advanced Tactics Used by Competitive Intelligence Professionals

Companies, intentionally or unintentionally, leave behind digital footprints; the trail of information that can reveal their strategies.

For example, companies leave digital footprints when they change their website copy about product descriptions, tweet about an event they are attending, post a job with a detailed description, publish case studies with the specifics of their engagement, receive employee feedback on Glassdoor or customer comments on G2, discussion forums, make quotes in press announcements, and many more.

Successful M&CI professionals leverage these signals to understand the market and stay ahead of competitors. This article presents eight such competitive intelligence signals and tactics, including why to track them, how to track them, who to share them with, and how frequently.

Here are eight tactics from the real world of CI applications to get you started:

1. Positioning or messaging changes

2. New product features and enhancements

3. Pricing changes

4. Customer reviews

5. Job postings analysis

6. LinkedIn analysis

7. Sales calls with prospects

8. Support/ help documentation

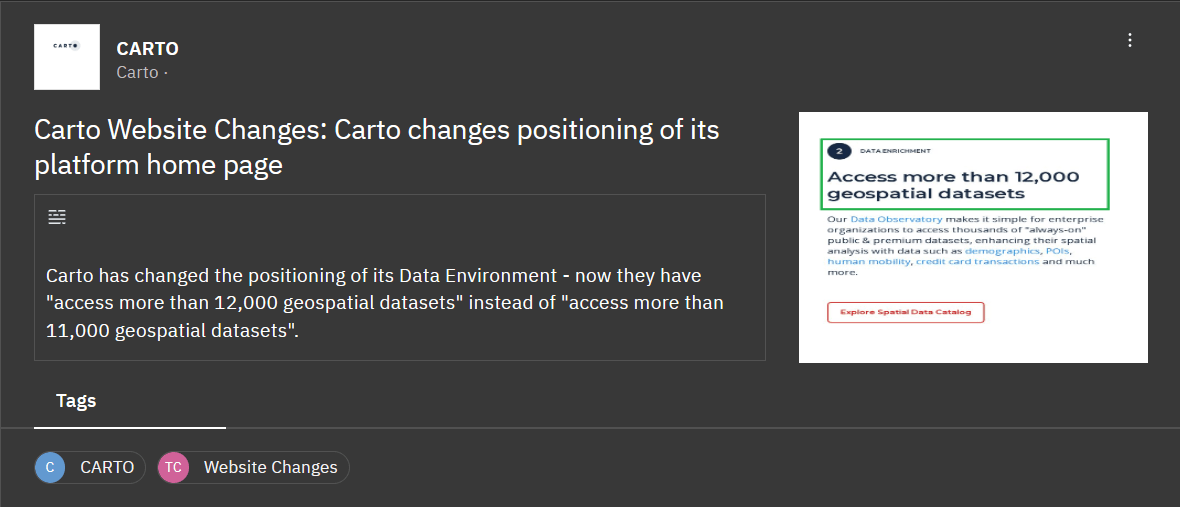

1. Positioning/ Messaging

Why to track it?

Tracking how competitors communicate and position their offerings provides a key insight into understanding their strategic thinking. Pay close attention to shifts in language, how they describe their offerings and company, and their ‘choice of words’ in news releases and press statements.

Individual pieces of competitors’ publications might not be strategically significant. However, an aggregated analysis over time could reveal their (changes in) positioning strategy and their target customer segment.

Subtle changes in messaging could reveal strategic shifts and new directions. This insight is foundational for carving out your products’ differentiation in your target customer’s mind.

How to track it?

Regularly monitor changes on competitors’ websites, including homepages, product pages, and solution descriptions. Delve into company websites, focusing on sections like Resources, Blogs, Case Studies, White Papers, or Press Releases.

Additionally, keep an eye on news, trade journals, and magazines, which frequently feature thought leadership articles, interviews, case studies, surveys, or reports from industry players.

Social media platforms like LinkedIn, Twitter, and Facebook are also crucial, as companies regularly share their latest publications there. Subscribing to competitors’ emails and newsletters is another effective way to stay informed about their positioning and messaging.

Who to share it with?

– Strategy: Major shifts in competitor positioning often signal a strategic business redirection. It’s crucial for the strategy team to dissect the reasons behind these changes, gauge their impact on the market, and consider if your own strategies need tweaking to maintain competitive differentiation. These shifts might open doors for new opportunities or for reinforcing your market position.

– Marketing: Changes in competitors’ positioning could be a springboard for refreshing your marketing approach. The marketing team needs to scrutinize these insights, revisiting and possibly revising your current marketing materials, campaigns, and messaging to preserve and improve your market differentiation.

When to share it?

Major shifts in competitor positioning are uncommon unless your competitor undergoes a major rebranding initiative. Analyze your positioning compared to your competitors at least once every quarter for fast-evolving segments and bi-annually for the rest of the categories.

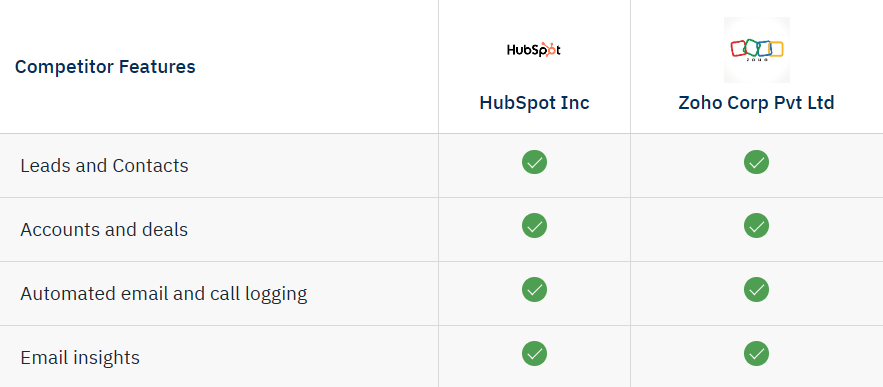

2. Product Features

Why to track it?

Keeping tabs on competitors’ new features and enhancements is necessary for benchmarking your product. To stay competitive, your product must meet, if not exceed, the baseline expectations set by your competitors.

By analyzing what’s new in your competitors’ offerings, you can pinpoint where your product might be falling short and make necessary upgrades. This ongoing tracking serves as a source of inspiration for your product team, sparking ideas for fresh features.

It also gives you a sneak peek into your competitors’ strategic goals and priorities, providing key insights for shaping your product roadmap and marketing tactics.

How to track it?

Primarily focus on competitors’ websites, particularly product updates and news sections, as well as their press releases, social media channels, and analyst reports.

Sales call recordings, win-loss analyses, and feedback from customer review platforms like G2 and Capterra are equally valuable sources. Sometimes, industry-specific trade publications and patent filings can also yield crucial intelligence on competitors’ products.

Who to share it with?

– Product Development: These insights are essential for product teams to ensure your current products remain market-relevant. They need this intelligence to identify gaps so that they can add new features to keep their products competitive and aligned with customer demands.

– Marketing: Crucial for tailoring messaging and positioning by leveraging insights into how competitors introduce and explain the benefits of new features. These insights also help develop tactics to differentiate your products and expand market share.

– Sales: It is important to stay informed about the changes in the competitors’ products and their implications for the users. It is essential to proactively develop sales strategies to answer questions in sales calls and craft persuasive sales pitches.

– Strategy: Insights into competitors’ are critical for informed long-term planning, identifying opportunities, and guiding strategic direction.

– Executive Leadership: Only significant product launches are relevant for the executive leadership team. Leadership could leverage competitors’ product insights for informed resource allocation, aligning business direction, and investment strategies for agility and long-term success.

When to share it?

Updates on new features and enhancements should be shared with the product development and marketing teams as they occur. For the strategy and executive leadership teams, a quarterly briefing is sufficient unless there is a significant or major development by your competitor.

For any significant development, a real-time alert along with its implications, is recommended. A comprehensive deep-dive analysis should follow soon.

Additionally, a comprehensive product feature analysis is recommended before starting major product development initiatives or strategic planning meetings.

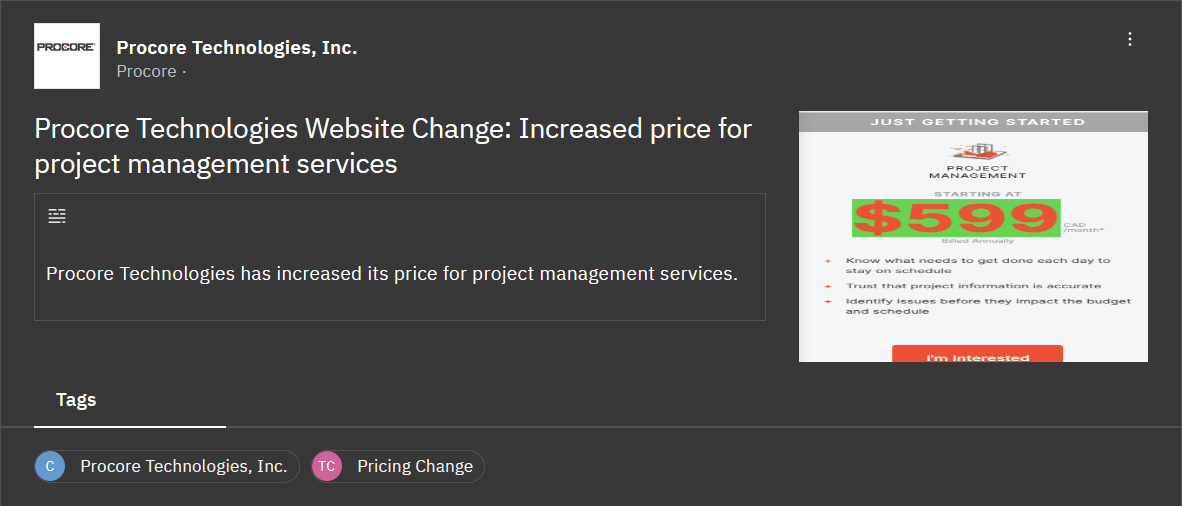

3. Pricing Changes

Why to track it?

Monitoring competitors’ pricing changes is not just about keeping your prices updated, it is a strategic necessity. These changes offer deep insights into changes in competitors’ strategic thinking about their market positioning and target segments.

A price drop might suggest a push for greater market share, a pivot to a more price-sensitive segment, or even financial distress. This should nudge you to consider countermeasures like feature enhancements or promotional tactics.

Conversely, a price increase could suggest a move towards a premium market segment. That is, they are focusing on increasing profits by serving high-value customers.

This could imply their focus on profit maximization or sufficient brand differentiation for commanding higher prices. Such insights allow you to re-evaluate your target segments and pricing strategy.

How to track it?

Regularly monitor any changes on competitors’ pricing pages. However, in B2B, especially for enterprise software, listed prices often differ from actual transaction prices due to sales negotiations and discounts.

Hence, the most reliable intel often comes from sales teams’ interactions with prospects and customers. Additionally, conducting win-loss analyses post-deal closures offers critical insights.

Keeping your teams constantly informed about competitors’ latest pricing can be pivotal, as pricing can sway customer decisions, even with a superior product or service.

Who to share it with?

– Executive Leadership: Insights based on the changes in competitor pricing are critical to assess competitors’ strategic direction. It enables leadership to develop strategic priorities — decisions about pricing, product portfolio, and market positioning.

– Strategy: To analyze competitor pricing strategies, identify new opportunities and potential threats, and refine competitive differentiation strategies.

– Sales: To adapt sales tactics and stay competitive with knowledge of competitors’ prices. Close more competitive deals by tailoring sales strategies to specific competitors’ offers.

– Marketing: To develop timely marketing tactics based on these price changes. Use these insights to develop targeted marketing campaigns emphasizing unique value propositions compared to competitors.

– Product Marketing: To update battle cards, adjust your messaging and positioning with respect to the new prices, and optimize it to maintain your differentiation.

When to share it?

Understanding pricing changes requires more than just a few data points; it’s about discerning whether these changes are anecdotal or part of a systematic trend, validated by multiple sources.

Regularly incorporating pricing insights into your reporting cycles, either monthly or quarterly, is essential. However, if there’s a substantial and confirmed change in pricing, it’s crucial to inform your stakeholders immediately.

This could be through instant alerts or included in your daily or weekly newsletters, ensuring that key decision-makers are always in the loop with the most current pricing information.

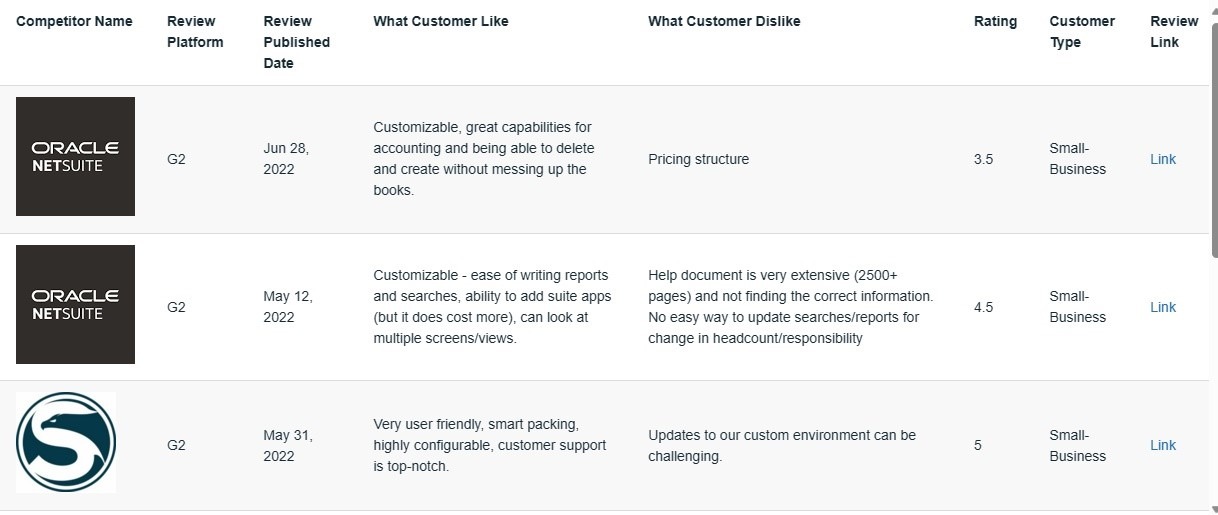

4. Customer Reviews

Why to track?

Review sites are a treasure trove of competitive intelligence. By tracking what the customers say about competitors’ products, you gain access to the internal details of their strengths and weaknesses.

Plus, you get invaluable competitive insights that can otherwise be obtained only by primary research interviews. These sources provide excellent information for your battle cards.

These are also sources for strategic insights into customer satisfaction, preferences, and overall likes and dislikes related to your product category. You can benchmark your products against competitors, identify gaps, prioritize tasks, and include them in your product roadmap.

How to track?

Sites like G2, Trustpilot, or industry-specific review platforms. Also, social media platforms like Twitter, Facebook, and LinkedIn, where customers often share their experiences in the comments of your competitors’ posts.

Who to share it with?

– Sales Enablement: They will utilize the information to create effective battle cards that equip the sales team with key insights and strategies to counter competitors.

– Product Marketing: Will leverage the intelligence for developing competitive differentiation in marketing strategies and communication.

– Product Development: Can incorporate these insights into product development plans, focusing on creating superior products and enhancing user experience.

– Executive Leadership: Can use the information for strategic decision-making, ensuring alignment with market trends and competitor movements.

When to share?

Not all reviews have unique information that can be used strategically. Many times, they repeat the same message. These should be analyzed over a period of time to draw insights to develop a better product and update the battle cards. If a user review is significant and reveals something of strategic importance, it should be shared immediately with the relevant teams.

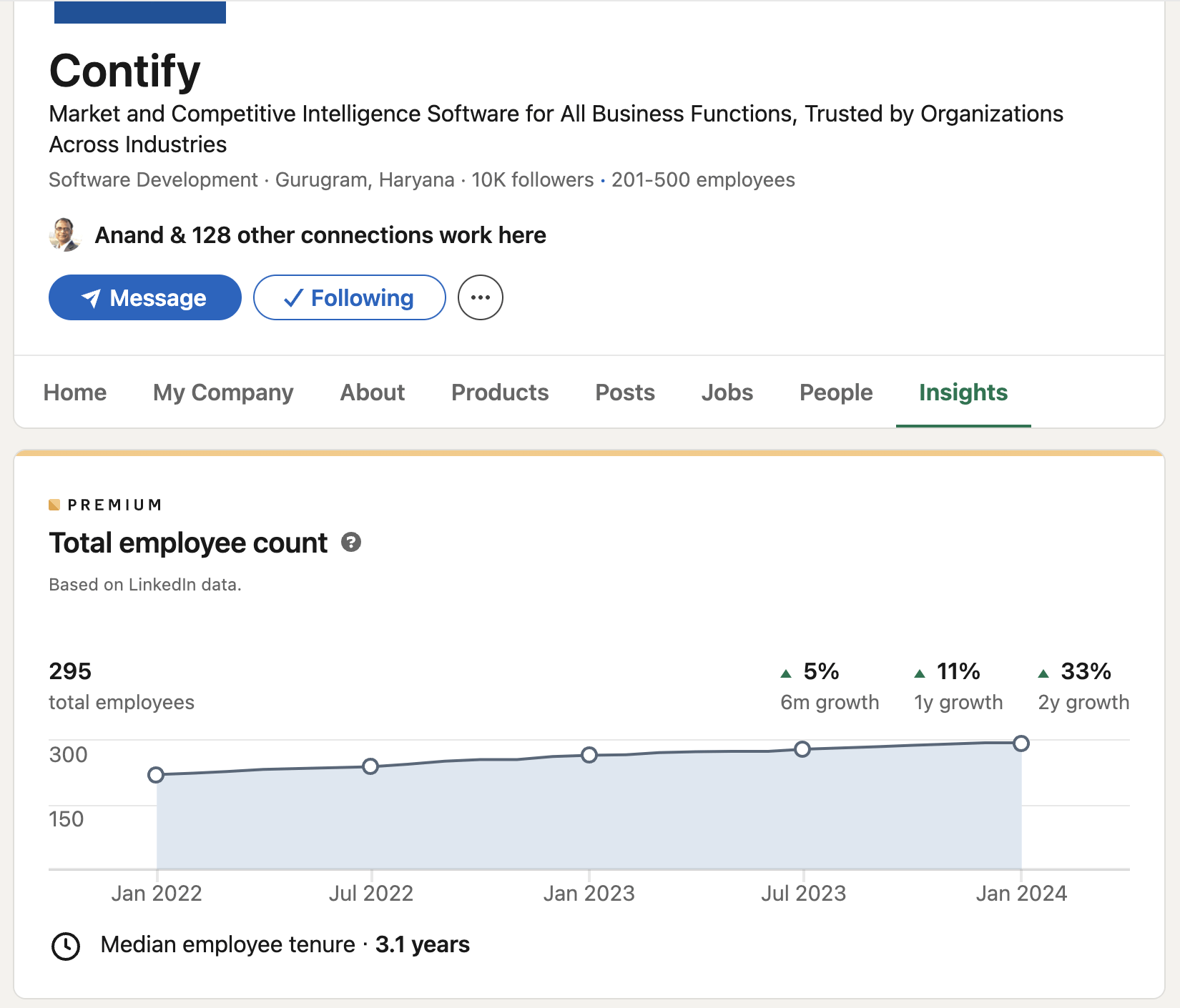

5. Job Postings

Why to track?

Analyzing individual job postings might not reveal actionable competitive insights. However, aggregating and analyzing them over time could be your secret weapon for unraveling competitive strategies and understanding market dynamics.

By analyzing competitors’ job postings, you can gain insights into their strategic moves, focus areas, and potential weaknesses or gaps in their capabilities. For example, descriptions in the job postings for sales, marketing, and product marketing could indicate target markets, customer segments, or product roadmap.

An increased number and frequency of job postings indicates a company’s growth, while a reduction could indicate possible challenges or strategic shifts.

Skills and technologies in job descriptions reveal insights about the company’s internal functioning. For instance, certain programming languages or software tools indicate their technology stack.

Job postings in new geographic locations signal a company’s expansion into new markets. This can be particularly useful for understanding their regional growth strategies.

How to track it?

Capture job postings on competitors’ websites (career pages) and job portals such as LinkedIn Jobs. Most of it can be automated by your MCI platform. If it is not provided by your existing vendor, you should evaluate other platforms, including Contify!

Who to share it with?

– Executive Leadership: C-level executives, VPs, and directors should receive these reports to inform strategic decision-making.

– Marketing and Sales: Both these departments can benefit from understanding industry trends, competitor strategies, and market dynamics.

– Product Development: Insights into emerging skills and technologies can inform product development strategies and innovation efforts.

– Strategy: Teams responsible for long-term planning can use this information for market analysis and identifying future opportunities or threats.

When to share it?

The frequency of job posting analysis depends on several factors, most importantly industry dynamics.

In fast-moving industries like technology or finance, conducting this analysis quarterly or even monthly can be beneficial to keep up with rapid changes. A semi-annual or annual analysis might suffice in more stable industries.

If your company is in a growth phase or entering new markets, more frequent analysis (monthly or quarterly) can provide valuable insights to support these initiatives.

Regular monitoring (monthly or quarterly) in highly competitive environments is crucial to stay ahead of competitors.

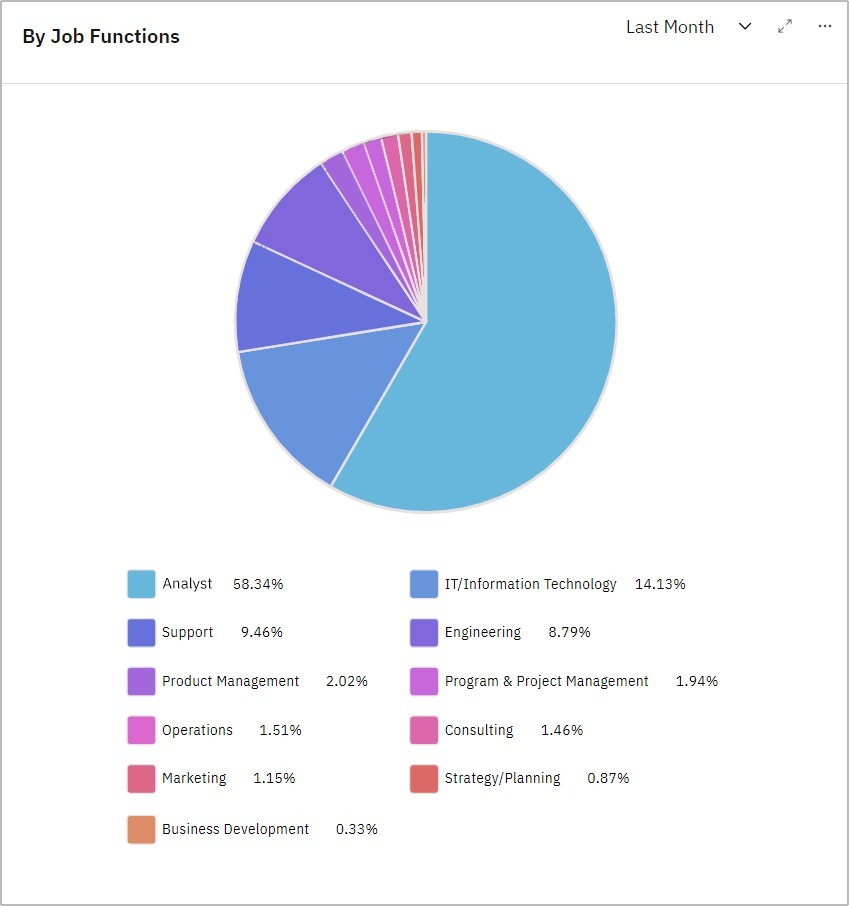

6. LinkedIn

Why to track

In addition to following the LinkedIn channels of competitors, you should also follow its employees. Their posts can reveal unique insights that are not available anywhere else.

LinkedIn posts featuring internal office pictures or casual events can provide insights into the competitors’ culture, values, and overall employee morale, which indirectly impacts the market performance.

Announcements by new employees about joining, not just at the leadership level but across the company, can signal shifts in focus areas, expansion, or expertise that could impact their future strategies. Trends about attending or participating in industry events indicate competitors’ strategic focus.

Even more insights can be gleaned by doing a trend analysis. For example, the overall employee count could indicate the health of the organization.

How competitors engage with their audience on social media, address concerns, or celebrate successes provides insights into their support and customer success strategies.

How to track?

Unfortunately, LinkedIn monitoring is difficult to automate. You need significant manual efforts to track the posts and changes and compile them in a report. Alternatively, you can leverage the managed services of your M&CI platform provider.

Who to share it with?

– Marketing: Understanding competitors’ content, campaigns, and audience engagement helps refine marketing strategies and messaging.

– Sales: Insights into competitors’ new offerings, events, and market focus can inform sales strategies and stay current on the latest competitive developments.

– Product Development: Information on new features, services, or focus areas helps guide product innovation and development priorities.

– Strategy: Strategic planners use this information for broader market analysis, opportunity identification, and strategic positioning.

When to share?

The frequency of tracking LinkedIn posts should align with the pace of change in your competitive landscape and the nature of the insights you seek. For a fast-paced environment or during critical periods (like product launches or major marketing events), monitoring could be fortnightly or monthly.

But for a more thorough analysis, diving quarterly or twice a year works best. The key is to collect enough data for trend analysis and pattern recognition, and then validate hypotheses about strategic moves by competitors.

7. Sales Calls with Prospects

Why to track?

Listening to sales conversations with potential clients before they engage with your product or become customers is an invaluable source of market insights.

At this early stage, prospects haven’t been influenced by your sales pitch or product demo. They talk openly about their challenges and the solutions they’re missing, giving you a raw, unfiltered view of their needs.

This kind of direct and unfiltered conversation with your target audience is often more insightful than any other resource when it comes to understanding your market and customers, and developing innovative solutions.

Moreover, if these prospects have considered your competitors, their insights can shed light on the competitors’ strengths and weaknesses. This is a unique and rich source of primary intelligence that only you have access to through these conversations.

Such discussions are a goldmine for understanding what an ideal solution looks like for your customers and their objections to your product.

Where to track?

Sales team calls must be recorded – no exceptions! It’s crucial to have their transcripts accessible for thorough analysis. Your Market and Competitive Intelligence (M&CI) platform should be equipped to integrate these call recordings and transcripts. This is key for delving deeper into customer insights and enhancing your understanding of competitive offerings.

Who to share it with?

– Executive Leadership: For senior leaders, this feedback provides insight into your target customers helping inform broader business strategies and decisions.

– Marketing: Marketers use this feedback to adjust messaging, campaigns, and content strategies. Knowing what users say about competitors allows them to identify differentiated features, address perceived weaknesses, and target areas where they feel competitors are lacking.

– Product Management: Insights into customers’ pain areas, challenges, and ideal world, can guide product development and feature prioritization.

– Strategy: Strategy teams use this information to assess market positioning, identify opportunities for differentiation, and inform long-term business strategies. It helps them understand the customers and plan moves that will give the company a strategic edge.

When to share?

We should be careful about not sharing any anecdotal information that surfaces in these conversations. We should first develop the hypothesis, validate it, and then share it with the relevant function. Integrate these insights into regular reporting cycles (monthly or quarterly) to ensure ongoing strategic alignment of your organization with the evolving customer needs.

8. Support/ Help Documentation

Why to track it?

Support documentation is an incredibly rich, unbiased source of intelligence on your competitors’ products. Assuming these documents are up-to-date and precise, they offer more detailed insights into competitors’ offerings than any other public source.

This is because they are designed to assist users in operating the product, rather than selling it. With support documentation, you get the straightforward truths and facts about competitors’ products, without the need to decode marketing jargon.

“If I only had one resource at my disposal, I would almost always take support documentation,” said Mindy Regnell, Principal M&CI Manager at Postscript.

Where to track it?

Primarily, support documentation is available on competitors’ official websites, particularly in sections dedicated to customer support or resource centers. These documents may also be available in online forums, professional groups on social media, or platforms like GitHub for tech-related products.

Who to share it with?

– Product: By analyzing competitors’ support docs, they can pinpoint areas for product improvement and get ideas for new features that address user needs.

– Marketing: Insights from these documents help in crafting precise marketing messages that highlight our product’s strengths against competitors’ weaknesses.

– Sales: Knowledge of features and issues in competitors’ products equips the sales team better to position our product as the superior choice during pitches.

When to share it?

Regular updates, such as monthly or quarterly, should be scheduled to keep relevant teams informed. However, immediate sharing is necessary if the documentation reveals significant changes in competitors’ offerings, like new features or addressing previous limitations. This allows your teams to adapt strategies and maintain a competitive edge rapidly.

Conclusion

As the modern business landscape grows increasingly volatile and the average lifespan of companies continues to shrink, the necessity for a robust market and competitive intelligence (M&CI) program is more crucial than ever. By weaving together intelligence from various sources, organizations can develop a holistic market perspective, essential for making well-informed decisions across all departments.

The advanced competitive intelligence tactics and applications discussed in this article highlight that starting an M&CI program is just the beginning. To truly stay ahead, we must continually refine our strategies, deeply dissecting the competitive landscape by leveraging every piece of available competitive intelligence.

A comprehensive competitive intelligence tool like Contify platform, which integrates diverse intelligence sources and employs AI for deeper insights, is your essential first step toward building a market-intelligent organization.